Incentive Stock Options (ISOs), also called qualified stock options, are used by employers to attract, reward, and retain employees. Unlike other stock options, ISOs can receive a much more favorable tax treatment if specific requirements are met. Those requirements, however, increase the risks and complications. Knowing how and when to exercise will improve your chances of optimizing the ISOs value and tax benefits.

What is a stock option?

A stock option grant gives you the right to buy shares of stock at a specific price during a particular window. The most common stock options are restricted stock units (RSUs), Non-qualified stock options (NSOs), and ISOs.

There are 5 items you must understand when it comes to ISOs:

- GRANT DATE: The date the stock options are given to you.

- VESTING SCHEDULE: This is when you can exercise your options and how many shares can be exercised.

- EXERCISE PRICE: This is also called the strike price or grant price, the price per share you’ll pay for the stock.

- GRANT EXPIRATION DATE: ISOs have an expiration date of not more than ten years or five years if you are a 10% or greater stockholder. You lose your vested options if you haven’t exercised by the expiration date. If you quit or retire, vested ISOs must be exercised within three months after you leave your job. However, more extended periods apply upon disability or death.

- BARGAIN ELEMENT: The difference between the option’s exercise price and the market price when exercised. Remember this – you’ll need it later.

What Are the Benefits of ISOs?

ISOs allow you to buy shares of stock at a price below the actual market value. For example, if your company grants you the option to purchase 1,000 shares at an exercise price of $20 per share, but the market value of those shares is $50, you can buy $50,000 worth of stock for $20,000. That’s not a bad deal!

There are no tax consequences when you receive an ISO grant or exercise that option. Instead, you report the taxable income only when you sell the stock. The most significant benefit is the unique tax advantage received when you trigger a qualifying disposition.

Qualifying Disposition of an ISO

A qualifying disposition occurs when you wait to sell shares acquired both

- One year after you exercise your ISOs AND

- Two years after they were granted.

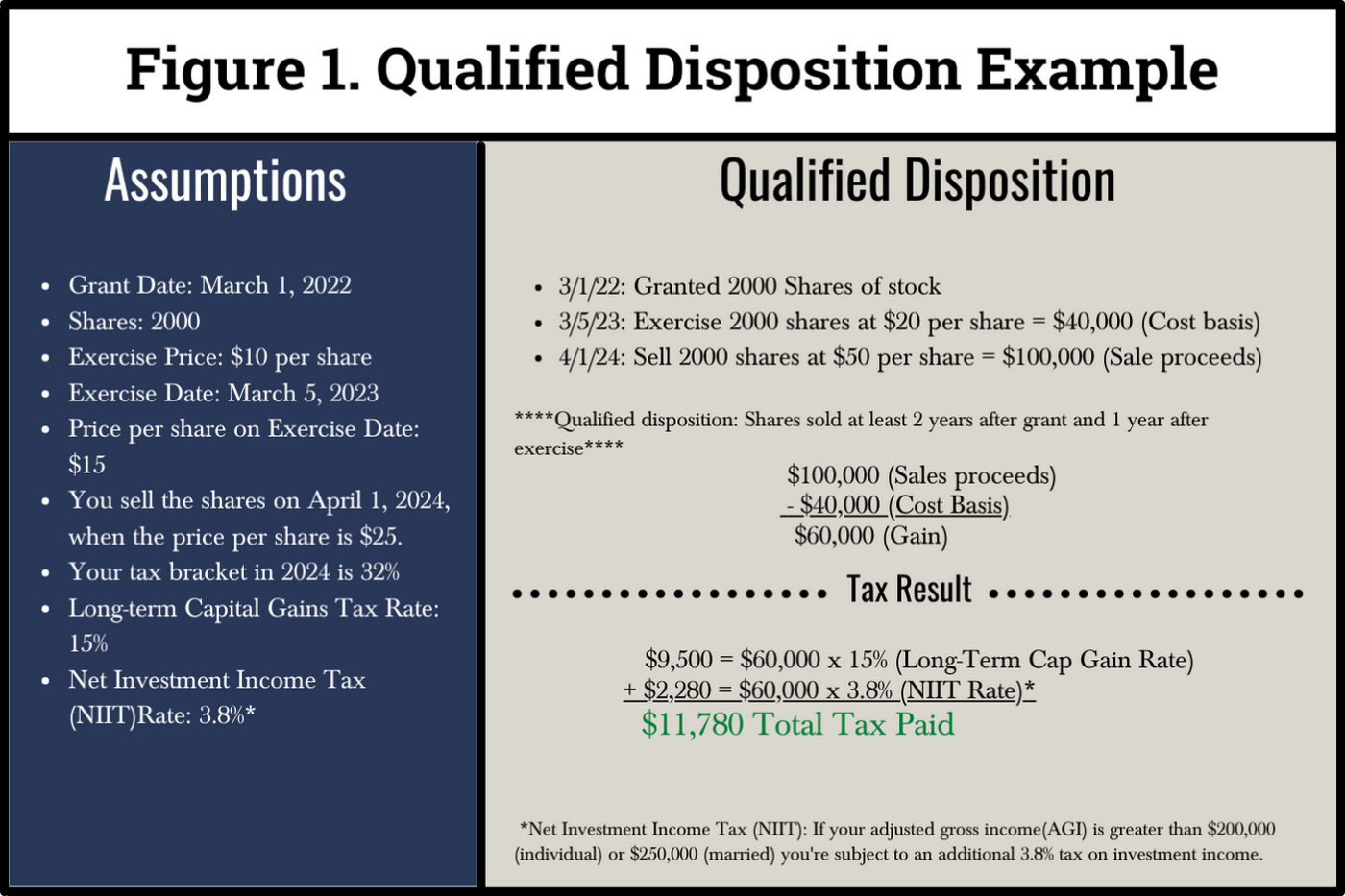

This results in gains from the sale being taxed at the lower long-term capital gains rate instead of short-term capital gains, which are ordinary income tax rates. See Figure 1 below for a qualifying disposition example.

Both requirements for a qualifying disposition have been met. The sale was over two years since the options were granted and more than one year from exercise. The gain from the sale will be taxed at the long-term capital gains rate of 15% (based on your income), resulting in $1,410 in tax, including the NIIT.

Disqualifying Disposition of an ISO

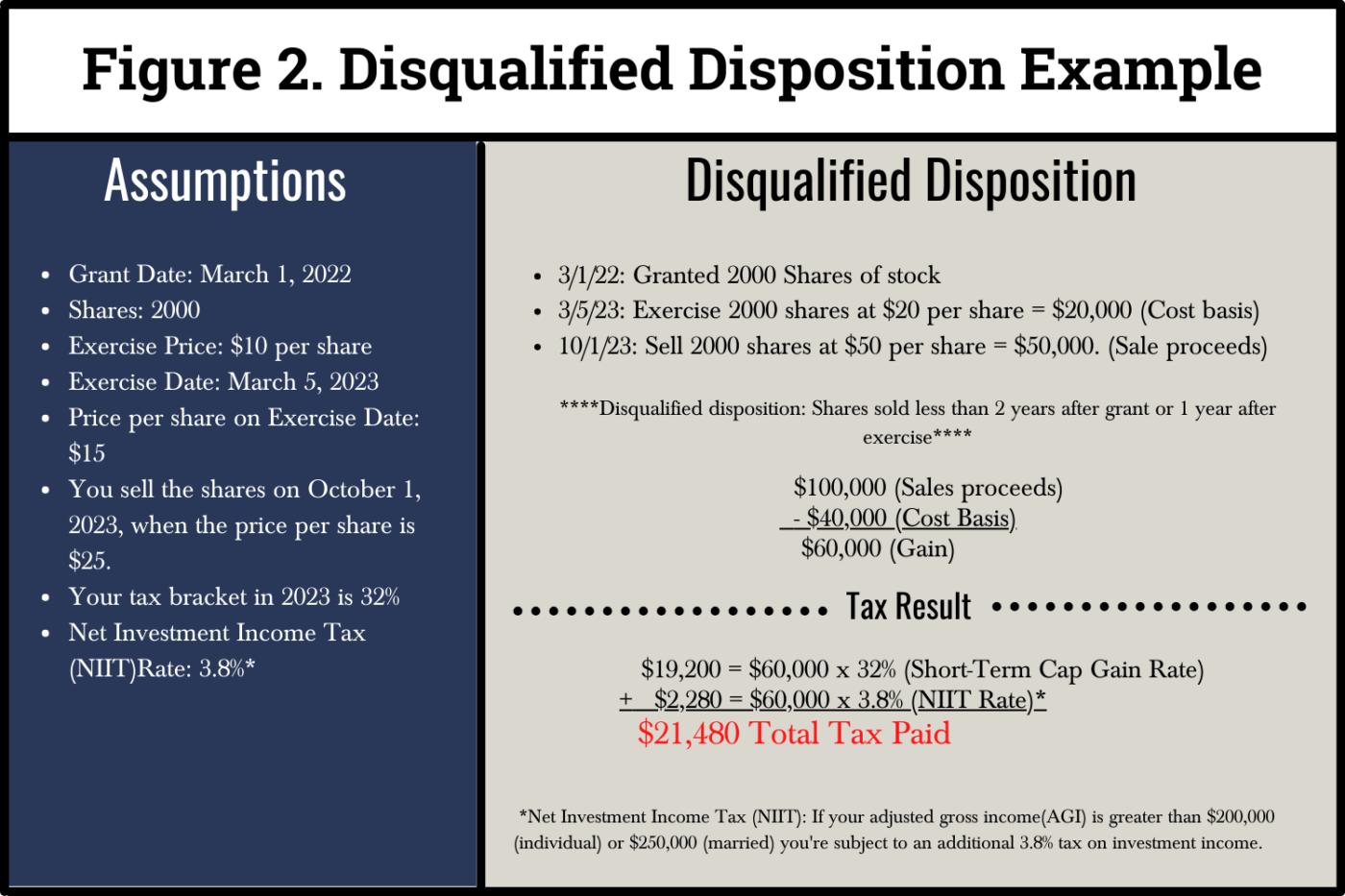

Suppose you fail to fulfill either of the waiting period requirements for a qualified disposition. This results in a disqualifying disposition, and you lose the lower long-term capital gain rate. In Figure 2, we use the same set of facts from Figure 1, except that dates have changed.

In the Disqualifying example in Figure 2. The sale date was not more than two years from the grant date, nor was the stock held for at least one year after the exercise date. When a disqualifying disposition is triggered,

- The bargain element (difference between FMV on the exercise date and exercise price) is taxed as regular income and should be reported on your W-2.

- The difference between the FMV on the exercise and sale dates is taxed as a capital gain. In our example, the bargain element of $60,000 is taxed at regular income tax rates or 32%.

The capital gain rate will depend on whether it is a long-term or short-term capital gain. If you held the shares for at least a year and a day, you’d be subject to the more favorable long-term capital gains rates. If less than a year passes before the sale, like in the example, they are considered short-term capital gains and taxed as ordinary income.

ISOs and the AMT

Another catch further complicates ISOs’ taxation—the Alternative Minimum Tax (AMT). Taxpayers who receive income from passive sources such as tax-free municipal bonds or ISOs and have numerous deductions may be subject to the AMT.

The AMT was created to force taxpayers who try to reduce their taxable income by using specific strategies to pay a minimum tax of 26% or 28%, depending on their income.

What is the AMT requirement for ISOs?

- When you exercise options, unless you sell your shares in the same calendar year, you must report the bargain element as taxable income for AMT purposes in the year you exercise the options.

- If you exercise and hold the shares for more than a year, you must report that gain for the AMT when you sell the shares.

Just because you must calculate and report the ISO transactions for AMT purposes does not mean you’ll be subject to the AMT. However, if your exercises and sales land you in AMT territory, you could have a significantly higher tax bill than you would otherwise.

The sort of good news is that if you’re subject to the AMT, you’ll receive an AMT credit in that year that can be used to lower your taxes in future years. Of course, there are limitations regarding when you can use an AMT credit. Even the AMT credit rules are complicated.

One way around the AMT is to create a disqualifying disposition and sell your shares in the same year you bought them. You won’t be subject to the AMT. Instead, you’ll be subject to ordinary income tax. However, then you lose the tax benefits of an ISO.

Exercising ISOs

How you exercise your shares depends on your available choices and financial circumstances.

- Cash Exercise. You buy the stock for cash. That’s pretty straightforward.

- Cashless Exercise. This doesn’t require you to come up with cash. The brokerage firm loans the funds to buy the stock at the exercise price, and you immediately sell. You then repay the loan amount in addition to commissions, interest, and withholding tax. Unfortunately, this method results in a disqualifying disposition.

- Stock Swap Exercise. This arrangement is when an employee gives the brokerage firm shares of company stock they own to cover the purchase. Yes, this means you have to buy the shares independently, but it will allow you to hold the options. This is a great strategy but does require more advanced planning.

Other ISO tidbits

Yes, there are even more considerations you have to take into account regarding ISOs.

- Limits on Issuance. Employers are limited to granting employees $100,000 or less of ISOs (valued as of the grant date) in a calendar year. When that occurs, the grant balance will often be made in NSOs.

- No Withholding. Other than the bargain element reporting, employers are not required to withhold taxes from ISO exercises. You may have to keep track, report, and pay estimated taxes.

- Stock Performance: There is always the risk of loss when you invest. Prices go up, and prices go down. The plan is that when you decide to sell your shares, the fair market value of those shares has significantly increased, but it doesn’t always work out.

ISO Headaches

ISOs are a double-edged sword. They have a significant tax savings potential, but they can become a tax nightmare if not planned properly. Qualifying, disqualifying, AMT, and stock performance. ISOs are some of the more complicated financial instruments to strategize. Calculations are complex, and several assumptions have to be made. Therefore, always, always, always have an ISO plan in place BEFORE you exercise your options.

ISOs aren’t for the faint of heart. If you have ISO grants, call us to help you with your strategy.