Investment properties diversify your portfolio but also add a layer of complexity to your finances. Ownership structure options, depreciation, and handling the tax consequences of a sale are all decisions where we often see investors making blunders with their rental property tax planning. Before you decide how to approach investment properties, you should know how to navigate the inevitable tax consequences.

Who owns what…

First of all, how are you going to own this new investment property? Our blog ‘Behind the scenes of a rental property investment’ explores some myths and various paths to get started in real estate investing. Electing the appropriate ownership structure for your investment is the first place we see investors make blunders in their rental property tax planning. Your new income source is an accomplishment but you must realize the IRS does not treat all income equally. Your investment property income from sources like a rental property is considered passive income. That passive income is treated essentially the same from a tax perspective whether you own the property in your name or an LCC.

The IRS treats an LLC as a pass-through entity when you elect for the LLC tax treatment. Each member of the LLC passes through their share of the gains or losses to their personal tax returns. The primary reasons for using an LLC in this way are less tax-centric and are more focused on anonymity and liability protection.

The passive income you receive from an investment property is not subject to self-employment tax, as long as you are not deemed a real estate professional by the IRS. The passive income rules dictate that you can only deduct passive losses from passive income. However, once you cross the line of being a real estate professional, the rules change. As a real estate professional, the passive income rules don’t confine you. You may deduct passive losses against nonpassive income.

In the eyes of the IRS, a real estate professional is an individual who meets both the following:

There is a cost to preparing your taxes, either your time if you are self-preparing or the fees if you hire a professional. The LLC ownership structure will also have increased costs every year at tax time. The tax preparation for an LLC by a CPA is usually more than a standard personal return due to the different requirements for a business return. Ultimately, you have to weigh the costs and benefits of each ownership structure for your situation.

Cash is flowing, depreciate it!

Once you own the property, you can begin to consider how to plan your tax strategy moving forward. Of course, you want your property to be cash flowing positively. When you have income, you must pay taxes on that income. One way to decrease your income for tax purposes is depreciation. Misunderstanding and not following the depreciation rules is the second place we see investors make blunders with their rental property tax planning.

Depreciation allows you to deduct the costs of maintaining the property. You may deduct an expense in one lump sum, or using the depreciation rules, spread the deductions out over the useful life of the property, which the IRS considers to be 27.5 years.

Without getting into the nitty-gritty, you and your tax professional use three key pieces of information to calculate the depreciation you may deduct each year. I highly recommend working with a tax professional to ensure your depreciation calculation is correct.

- Property basis | Similar to the cost basis in your taxable accounts, your basis in your investment property is the amount required to acquire the property.

- Cost segregation | You can only depreciate buildings, not land. You must separate the cost to acquire the building structure versus the cost to purchase the land.

- Depreciation schedule | You may use a chart provided by the IRS in Publication 946 to help you determine what percentage of deprecation you may deduct each year.

Your depreciation calculation will help you reduce your taxable income. As a property investor, you will use your Schedule E to report your rental income and expenses for each rental property. On your Schedule E, you will include depreciation as one of your expenses, reducing your tax liability. You enter the resulting net gain or loss on your 1040 form.

Time to sell! Nailing rental property tax planning

At some point in your real estate investing career, it will come time to sell a property. If your property has appreciated, congratulations! Your rental property tax planning now must focus on how to handle your gain most efficiently. The sale process is the third place we see investors make blunders with their rental property tax planning.

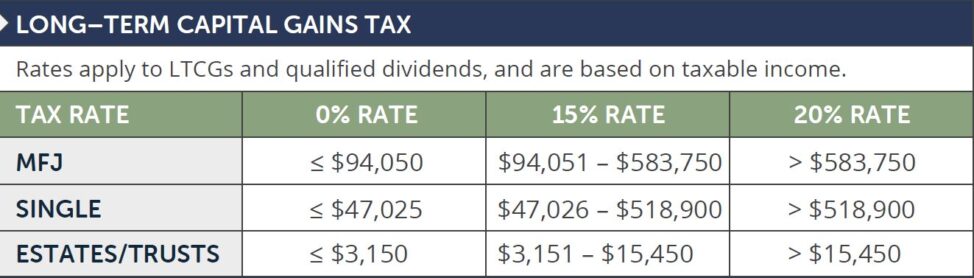

When you sell an investment property, your gains will be subject to capital gains tax rates. Luckily if you have owned the property for longer than one year, your tax consequence will be determined by long-term capital gains rates, which are a lower rate. Depreciation comes back into play when it comes time to sell. If the depreciation you have deducted over the years results in your adjusted cost basis being less than the sale price, you have to recapture that deprecation. The difference between your sale price and your adjusted cost basis is the deprecation recapture and is taxable at ordinary income rates.

1031 Exchanges

One way to defer your tax liability is by using a 1031 exchange. A 1031 exchange is a strategy to purchase a similar property to the property you are selling. By meeting the specific criteria of a 1031 exchange, you can roll your gains into the new property without paying taxes on the gain of your selling property. You can also avoid taxation on depreciation recapture, which is taxed at ordinary income rates.

Think of a 1031 exchange as a swap; the property you are considering to purchase must be similar to the one you are selling. The IRS refers to these similar properties as ‘like kind’ properties, they don’t have to be exactly the same, but they must serve the same purpose. For example, you can’t use a 1031 exchange to sell a multi-family rental unit and use the proceeds to buy something completely unrelated, like a new vehicle.

To qualify for the 1031 exchange special tax treatment, you must follow a very specific set of rules. To help you navigate these rules, you will use a ‘qualified intermediary.’ Your qualified intermediary will be neutral and independent, for example, not your accountant or lawyer. This person will serve the role of handling the logistics of the 1031 including the transfer of funds to ensure all the criteria are met to qualify for the special tax treatment.

1031 Timing

The first set of rules your qualified intermediary will help you with addressing the timing of the transactions. You have 45 days to identify a property to replace the property you are selling. The 45-day window begins when you sell your original property. Then, you must complete the purchase side of the 1031 exchange within six months or 180 days specifically.

Identifying your new replacement property comes with its own set of rules. There are three different ways you can identify your new property. Once you declare you will be using a 1031 exchange, your first option to meet the identification criteria is to select three potential properties. The cost does not matter, but you must actually purchase one of the three properties. The second option is to identify an unlimited number of replacement properties with a total value that is not more than 200% of your sale value. The last identification option is the 95% rule. The 95% rule allows you to identify as many properties as you would like, the value doesn’t matter, but you have to actually purchase at least 95% of the total value of your identified selections.

Once you have closed on your properties (buying and selling) you will complete and report the 1031 by filing the IRS form 8824 with your tax return. If you are crossing tax years mid transaction, you will file the form 8824 with your tax return in the year you sold your initial property.

There are ways to be tax-conscious and to avoid blunders in your rental property tax planning at various parts of your real estate investing career. As your income streams increase and become more varied, your tax planning opportunities will become increasingly complicated and increasingly valuable. Each of the tax strategies you consider for your investment properties requires consideration of your unique situation and should be in tangent with your long-term goals.

Please use one of the buttons below to share this blog with someone considering an investment property!