Even though various tax benefits are available to students and parents who save for college, attend college, and pay back student loans after college, other than a 529 plan, most people don’t think about them. You need to have a plan, not just to save but also to pay for college.

When the federal government changes the rules every few years, being on top of how best to navigate the tuition payments is challenging. The latest changes, The Tax Cuts and Jobs Act (TCJA) of 2017 and the SECURE Act of 2019, or SECURE Act 2.0 in 2022, have given taxpayers whiplash on what is and is not deductible.

Yes, no, maybe?

Tuition and fees deduction

The tuition and fees deduction was taken away in the TCJA but returned in the SECURE Act of 2019 and was removed again in 2020. As of 2024, there is no deduction for tuition.

Employee work-related education deduction

Before 2018, everyone was allowed to deduct unreimbursed education expenses as part of the 2% miscellaneous deduction threshold if they maintained or improved skills used in their current job or profession. However, this tax deduction was eliminated for most individuals via the TCJA. Unless you’re

- Self-employed individual

- Qualified performing artist

- Fee-based state or local government official (Ha, pretty convenient, they kept it for government officials!)

- A disabled individual with impairment-related education expenses

While they aren’t the most beneficial tax benefits, the tuition deduction and employee education deduction were popular. Losing these provisions will take a bite out of the tax benefits of the TCJA for some taxpayers. To determine if your work-related expenses are deductible, see Are My Work-Related Education Expenses Deductible?

Education tax benefits

There are two credit opportunities when you pay for college for those who qualify: the American Opportunity Tax Credit and the Lifetime Learning Credit. TCJA has not changed either of these credits.

1. The American Opportunity Tax Credit (AOTC).

The AOTC is a credit of up to $2,500 of undergraduate expenses per student, with up to $1,000 of the credit refundable – the most valuable type of credit (see Blog Break). There are, however, four requirements for the AOTC.

- The AOTC is only available for four tax years per student.

- It only applies to the first four years of post-secondary education before the end of the tax year.

- Eligible students must take classes at least half-time for at least one academic period and in a degree or certificate program.

- No felony drug convictions.

Qualified expenses at an eligible institution for the AOTC include:

- Tuition

- Student activity fees paid to the school

- books, supplies, and equipment required for a course

What is not eligible:

- Optional fees for things like student activities/athletics

- Health insurance

- Room and board costs

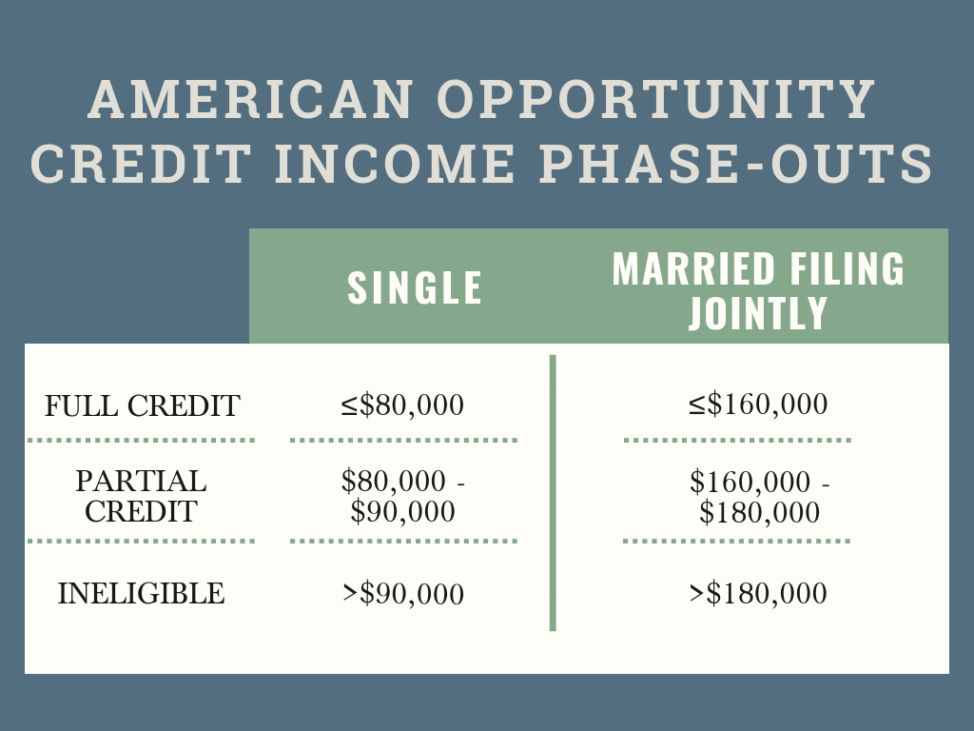

The AOTC gets phased out (reduced or eliminated) if your modified adjusted gross income (MAGI) is too high.

The AOTC equals 100% of the first $2,000 in qualifying educational expenses and 25% of the next $2,000 for a maximum annual amount of $2,500. Remember the best part of the AOTC? If your tax liability falls below zero, $1,000 of the credit is refundable! This credit is not adjusted for inflation.

2. Lifetime Learning Credit

The Lifetime Learning Credit, a credit of up to $2,000, can be claimed by graduate students or undergraduate students enrolled less than half-time or those who take more than four years to graduate. The credit also applies to undergraduate and graduate students who enroll in only a few classes at a time. It does not have to be a degree or certificate program. So if you want to learn something new and take a community college course, you are eligible for the Lifetime Learning Credit.

You can claim the lifetime learning credit for an unlimited number of years. However, the student must attend an eligible institution. Qualified expenses include tuition, mandatory enrollment fees, course materials, and books. However, optional fees don’t count. Neither do room and board costs.

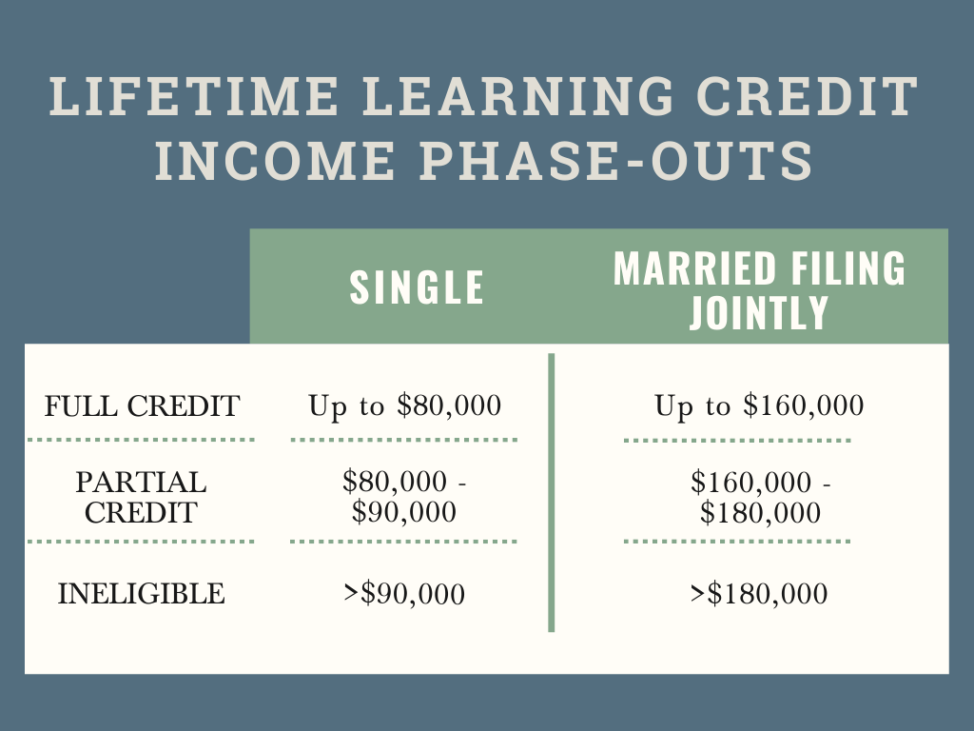

Like the American Opportunity Tax Credit, the Lifetime Learning Credit gets phased out if your MAGI is too high, but the income thresholds are lower. Thresholds are not indexed for inflation.

The maximum credit is $2,000 per year, equaling 20% of qualifying expenses up to $10,000. Unlike the AOTC, the Lifetime Learning Credit is NOT refundable.

Pay for college with multiple students

Only one Lifetime Learning Credit can be claimed per annual return, even if you have several eligible students. Also, you can’t claim the American Opportunity Tax Credit and the Lifetime Learning Credit for the same student in the same year. You can, however, claim the American Opportunity Tax Credit for one or more students and the Lifetime Learning Credit for another. Have you got that?

Next year’s tuition

The AOTC and Lifetime Learning Credit apply to all qualified expenses paid in the calendar year. If you pay those expenses in December 2022 for 2023’s spring semester, those expenses will count for your 2020 tax calculation.

Student loan interest deduction

The student loan interest deduction is among the most frequently used tax deductions. That’s not just because so many people have student loans but also because you can deduct interest on your student loan even if you don’t itemize your deductions. That means, thankfully, with the recent TCJA standard deduction increase, you won’t lose the student loan interest deduction.

It’s the student loan interest deduction, not the student loan interest tax credit. That makes a big difference. A credit reduces your tax, dollar for dollar, and is more valuable. A deduction reduces your taxable income. The benefit of a deduction depends on your income tax rate.

Up to $2,500 per year can be deducted. There are, however, a few requirements.

1. The loan is for the taxpayer, spouse, or dependent.

2. The loan was for qualified education expenses for an eligible student.

3. The loan must be for a student enrolled at least half-time in a program that leads to a degree or certificate at an eligible institution.

4. The loan must be from a qualified source. If your grandmother loaned you $25,000 for college, you can’t deduct the interest you pay her.

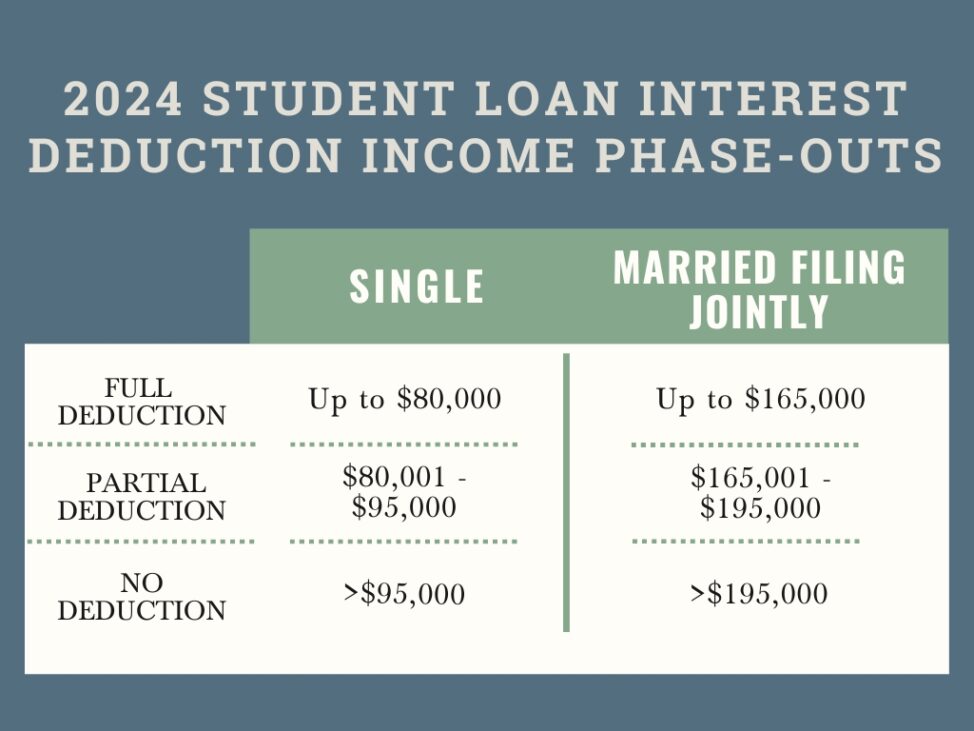

The student loan interest deduction has income phase-outs (surprise, surprise) if your MAGI is over certain thresholds.

If you are married and filing jointly, and both spouses are paying student loans, you can only deduct up to $2,500 in interest. Unfortunately, that’s not $2,500 per person but per income tax return. Please note if you are married-filing-separately, neither spouse is entitled to the student loan interest deduction.

Parent vs. Student: student loan interest deduction confusion

Here is a common point of confusion. When can a parent take the student interest deduction for their dependents? It comes down to whose name is on the loan. That’s who is legally obligated to pay the student loan.

Student name only

If it’s the students alone, they are the only ones allowed to deduct the student loan interest. However, if they are dependents of their parents, they cannot claim the deduction, nor can their parents.

Even if parents pay the student loans for their dependents, the parents cannot take the student loan interest deduction. The parents are not legally obligated to make payments – their names are not on the student loans.

The student may still claim the deduction based on payments made by the parent (as long as they aren’t a dependent on someone else’s tax return). For example, if you have student loans and are on your own, but your parents still pay your loans (lucky you), they cannot take the deduction, but you still can.

Student & parent as co-signer

A parent who co-signed a student loan could claim the student loan interest deduction if they paid the loan AND the student is a dependent. Again, like the example above, the student may take the deduction if the parent paid and they are not a dependent.

Is that clear as mud?

Coordinate the tax benefits

When saving and paying for college is the goal, you need to take advantage of any tax benefit. A mixture of 529 distributions along with tax credits does help.

Income thresholds

The first step is reviewing the respective credit or deduction income thresholds. If your income is slightly above the threshold level, it may pay to increase retirement plan, HSA, or FSA contributions. Kicking in a few additional retirement or health savings dollars to gain a tax credit is a good trade-off.

An HSA, FSA, or other benefit deduction is generally selected during open enrollment. Figuring out your taxable income that far into the future is difficult, but it’s worth the extra work effort to make these projections.

A 529 and AOTC – where the tax magic happens

The AOTC equals 100% of the first $2,000 in qualifying educational expenses and 25% of the next $2,000, for a maximum annual amount of $2,500 for the first four years of an undergraduate degree, for a total of $10,000 over four years. Remember the best part of the AOTC? If your tax liability falls below zero, $1,000 of the credit is refundable!

You cannot claim any of the college tax credits based on expenses paid with the tax-free portion of a 529 plan distribution.

Claiming the AOTC and using a 529 plan takes coordination. For example, if you take $10,000 out of a 529 plan to pay for tuition, you cannot use that $10,000 of tuition expenses to claim the AOTC. However, if tuition is $20,000, and you use a 529 plan distribution to pay for $16,000 and pay the rest with cash or a loan, you can get the best of both worlds. Tax-free 529 plan distributions and the AOTC if you meet all other qualifications. That’s a $2,500 credit for paying $4,000 of tuition.

What about the Lifetime Learning Credit and 529 Plans?

The Lifetime Learning Credit is not as beneficial as the AOTC because income thresholds are lower, the credit is not as high, a higher amount of tuition is required to receive the maximum credit, and the Lifetime Learning Credit is not refundable.

That doesn’t mean you should avoid it or not try to coordinate, but you don’t get as much bang for your buck. Let’s use the same example from the AOTC for the Lifetime Learning Credit.

The maximum credit is $2,000 per year, equaling 20% of qualifying expenses up to $10,000.

If tuition is $20,000 and you use a 529 plan distribution to pay for $10,000 and pay the rest with cash, assuming you meet all of the qualifications, you’ll receive the Lifetime Learning Credit of $2,000. Let’s compare:

AOTC: Pay $4,000 of tuition, receive a $2,500 credit.

Lifetime Learning Credit: Pay $10,000 of tuition and receive a $2,000 credit.

It’s plain to see which is better, but these are just two specific examples. There are a plethora of variables that affect your taxes. Your income, number of students, your other deductions or credits, law changes, the list goes on and on. It takes tax planning in advance.

What about 529 plans to pay for college? Yes, I’ve only briefly touched on them here. You can learn more about the rules of 529 plans or check out the frequently asked 529 questions in my previous blog posts.

Plan to Pay for College

The tax benefits are not the reason one attends college. Nonetheless, when you have to pay for college, with a bit of planning, the payments can be used to your advantage to make college education saving and paying as tax efficient as possible.

Do you have any questions on how to pay for college or feedback you’d

like to share? I’d love to hear your thoughts, so please feel free to leave a

comment below so we can continue the discussion.