Failing to prepare a comprehensive tax strategy is a quick way to turn your retirement into a not so rosy picture. Taxes impact retirees in many ways. You should coordinate each piece of your retirement income stream to create a proactive retirement tax strategy. Owning company stock allows for a specific tax treatment called net unrealized appreciation (NUA). Electing NUA is not for everyone; your advisor should evaluate it as part of your overall retirement income and tax strategy.

If you have been granted stock from your employer, congratulations! You likely received employer stock over many years. Your shares of company stock are only one piece of your total retirement assets. The first step most people take after retirement is rolling over their 401k to a Rollover IRA. In the rollover process, you liquidate the investments you held in your 401k. In your new Rollover IRA, you select your new investments that fit your risk tolerance and retirement distribution plan. But wait, not so fast, you can’t forget about the company stock!

Know the rules

Your company stock has special taxation rules, and you have choices. When you work for a company with publicly traded stock, the company stock in your retirement plan can be eligible for net unrealized appreciation (NUA) tax treatment. Note, when referring to NUA, you must own company stock shares, not employee stock options. For more information on employee stock options, check out our blog post “How to Make an ESOP Work for You”.

NUA means that the company stock is subject to only capital gains tax instead of the higher income tax rates. Remember, IRA distributions are subject to income tax rates. NUA takes the difference of your company stock when you acquired it and its current value; that gain is subject to capital gains rates.

Which path to take?

At retirement (or even when you change employers), you essentially have two options to consider for your company stock. The first option is to roll it over into a Rollover IRA with the rest of the assets. The second option is that you could distribute the company stock to a brokerage account and roll the rest of your assets into a Rollover IRA.

Why would anyone take the latter? Let’s tackle the bad news first. The latter sounds complicated, and you’d be facing a tax bill right away. Well, the tax bill might not be as large as you’d think. You would be liable for income tax on only the cost basis of your employer stock. Then, you may continue to hold the stock indefinitely in the brokerage account.

Moving to the good news. Once you decide to sell the company stock, you would only be facing capital gains tax on the NUA and any additional gains since you moved the stock to the brokerage account. The NUA tax savings could make any analysis to determine the best strategy for your company stock very much worthwhile.

Taking advantage of NUA is amplified when your company stock has a low cost basis. With a low cost basis, NUA allows you to take a limited tax hit now on just the basis instead of paying income tax rates on the entire position later.

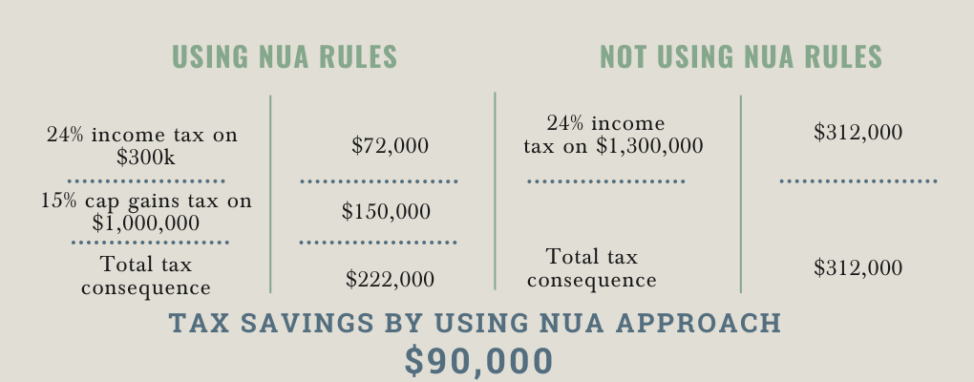

Let’s take a look at an example. John Doe is about to retire at 60. His 401(k) balance includes company stock. The cost basis of that stock is $300,000 and has grown over his career to $1,300,000. John Doe has two options:

Using NUA tax treatment

John will distribution the stock from his 401(k) to a brokerage account. He will be subject to income tax rates on the $300,000 (cost basis). The gain of $1,000,000 would not be taxed yet.

When he decides to sell the stock in the brokerage account, he would be subject to capital gains rates on the $1,000,000 NUA and any additional appreciation since moving to the brokerage account.

There is an advantage here for John’s estate planning as well. If he died before selling the stock, because it is held in a brokerage account, his heirs would receive a step-up in basis to the value of the stock at John’s death. Once the heirs decide to sell the stock, they would only be subject to capital gains tax on the gain since the value at John’s death and the sale. That could be significant tax savings for his heirs.

Not using NUA tax treatment

John will roll the entire balance of his 401(k) into a Rollover IRA. His assets would continue to grow tax-deferred. Once he begins to take distributions, the distributions will be taxed at ordinary income rates.

IRA assets do not offer a step-up in basis for beneficiaries. At John’s passing there would be no step-up in basis in this scenario.

The chart above is a simplified approach to a complicated decision. In order to accurately evaluate the potential benefit of using NUA treatment, you have to consider:

- your current tax situation

- the cost basis of your company stock

- the proportion of company stock to your total 401k(k) balance

- your overall financial position

- your future tax situation

If your financial plan is projecting you will be facing lower tax rates in retirement, NUA treatment will look less favorable the larger the balance of company stock you own relative to your total 401(k) balance.

The key is to pause and evaluate the possibility of use NUA before moving any company stock held in your 401(k), whether at retirement or when you are changing jobs. Dependent on your unique situation, you could use the NUA tax treatment to realize meaningful tax savings.

If you know someone who could benefit from this blog post, please pass it along to them using one of the ‘share’ buttons below!