Finding meaningful gifts for young adults can be challenging. What can you give them that’s impactful, useful, or has long-term benefits? No, not gift cards. Instead, here are four gift ideas to help young adults build a sturdy foundation to start their new independent financial journey.

1. The gift of student loan payments

According to a study by TD Ameritrade, 30% of millennials will delay moving out of their parent’s homes. The main culprit – is student loans. Can you think of a more appropriate gift for a young adult? Not me.

Help empty the nest

Why not pay some of their student loans? Whether you give one month or all twelve, this gift to young adults will allow them to save their income for retirement, a car, or to move out of your home! The gift of student loan assistance may be a gift to yourself as much as your young adult.

Student loans are a long-term drag, often paid back over ten years or more. Any assistance via gift to help pay them off sooner will have significant positive long-term benefits.

A note of caution: Don’t help to the detriment of your own finances or retirement. Taking out loans or withdrawing from your 401(k) to pay off their loans will help them but hurt you. You may want the kids to leave, but don’t go overboard. Take a measured approach so everyone wins.

2. Retirement gifts for young adults

The earlier you start, the better, so why not help young adults with traditional or Roth IRA contributions? The limit for 2024 is $7,000 for young adults ($8,000 for the not-so-young adults 50+).

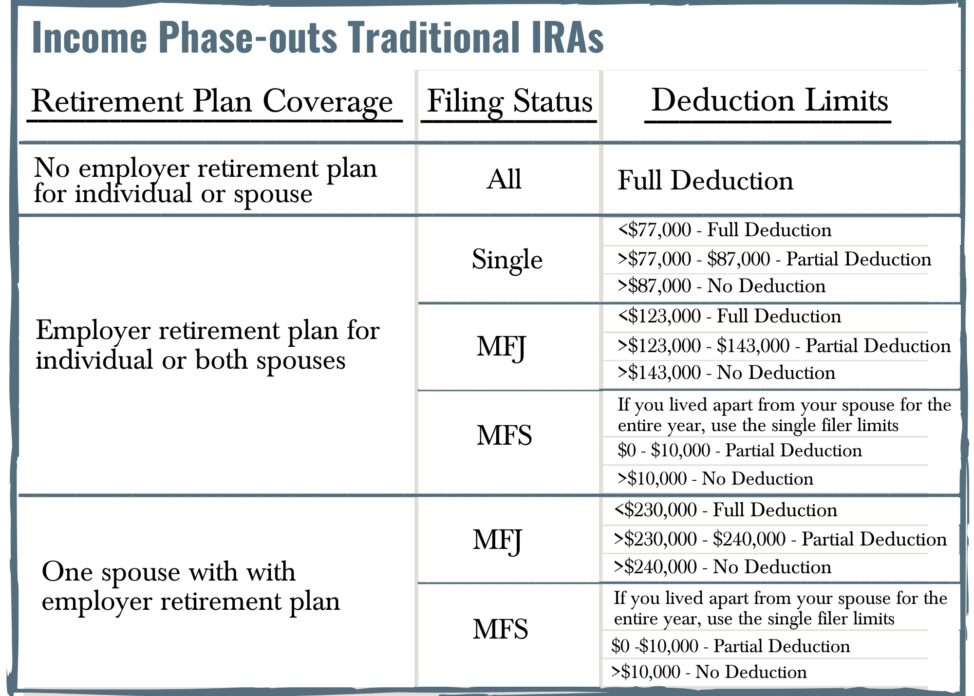

The young adult must have earned income to make any traditional or Roth IRA contributions. Please note, however, if their earned income passes certain thresholds or is covered by an employer-sponsored retirement plan, it may result in certain restrictions. Let’s break it down.

Traditional IRA

Contributing to an IRA is a wonderful gift idea. There are income restrictions when covered by a retirement plan. The first step is encouraging them to participate in the highest amount possible. At a minimum, it should be enough to get a full match if their employer provides one. Below are the income provisions.

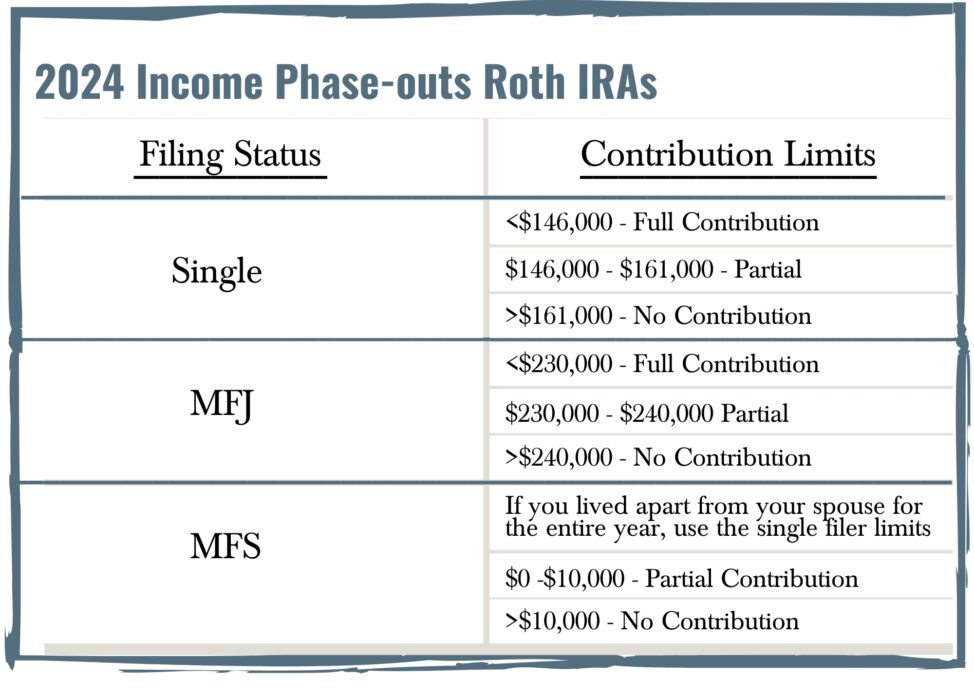

Roth IRA

The Roth IRA isn’t dependent on being covered by an employer’s retirement plan but does have income restrictions.

Gifting traditional or Roth IRA contributions to a young adult is a great way to provide a gift that will produce years of growth that can result in significant retirement benefits.

3. Set them up with a financial plan

Young adults often don’t know what they don’t know. So how can they be ready to be financially prepared adults? They risk making uninformed financial decisions, and it could cost them. Designing a plan and strategies to prevent missteps, reach goals, and develop good financial habits will pay dividends (literally!) later in life.

The perfect time for the young adult

Although some may disagree, the best time to gift a financial plan to a young adult is after they’ve worked for a few years and better grasped their career and life goals. A bright-eyed and bushy-tailed college graduate starting their first job could undoubtedly use some important recommendations. Still, I don’t think an in-depth, comprehensive financial plan is necessarily beneficial. In fact, it may even be too much for young adults to wrap their heads around.

Allowing the young adult a few years to grow, learn, become more independent, and, most importantly, start envisioning their future – that’s when a financial plan can be effective. Young adults will have more buy-in with the financial plan because they can picture the results.

Check out the Certified Financial Planner Board of Standards, The National Association of Personal Financial Advisors (NAPFA), or the Financial Planning Association (FPA) to connect with a trusted fee-only, fiduciary, CERTIFIED FINANCIAL PLANNERTM professional (just like us, hint, hint) who will create a plan for good financial habits.

4. Health Savings Account loophole

A unique loophole allows families to contribute to their child’s HSA at the higher family rate of $8,300 while still funding their own HSA at the family rate of $8,300. There are three conditions for using the loophole:

- The family must be on a high-deductible healthcare plan.

- Your child must still be on your health care policy. Remember, parents can keep their children on their healthcare policy until the child turns 26 years old.

- The child cannot be a dependent or file a joint return. Bear in mind parents may claim their children as dependents provided they are qualifying children under 19 years old or students under 24 years old.

A limited loophole

This strategy is only available to families for a limited period. Most children don’t claim themselves until age 22, give or take. Once a child reaches age 26, they can no longer be covered by their parent’s health insurance. So this strategy is a thread-the-needle one limited to 3 or 4 years. Once they have their own healthcare plan, their HSA contribution will be limited to $4,150.

How it works

When a child is no longer a dependent on their parent’s tax return, they cannot use their parents’ HSA for expenses. However, since the child is still covered under their parent’s insurance, they can open their own HSA and contribute $8,300, the family contribution amount, just for themselves. That’s a crazy loophole.

It doesn’t matter who contributes, the child or their parents. However, only the child can deduct the contribution since it’s their account.

Contributing an extra $8,300 to an HSA for a child for 3 or 4 years can add up. Imagine the benefits – either their own medical expenses, their future family’s, or if they really play their cards right, retirement medical expenses in 40 years – that’s a lot of years of compounding!

If you want to learn more about the benefit of an HSA, check out 7 Ways an HSA Can Help You Now and In Retirement

4. Young adults need estate plans too

Estate planning isn’t only for the old, I mean, mature. Everyone, including young adults, must think about how their assets will be distributed or their wishes adhered to in the event of a tragedy.

It also doesn’t have to do with net worth. You want to make things easier for the ones you love. That could mean avoiding probate or tough medical decisions. No need for anything complicated, just a few necessary pieces of paperwork to ensure a difficult situation isn’t made worse.

A young adult (or anyone) should always have a durable power of attorney and a health care proxy. Someone who can make health care and financial decisions if incapacitated.

Once they have their first job, they need to consider beneficiaries regarding company benefits, such as a 401(k) and life insurance. Everyone, not just young adults, must ensure they have primary and contingent beneficiaries named on each account.

Yes, young adults should have a will, even if they don’t have many assets. Otherwise, the court will decide who gets the assets.

I’m leery of online do-it-yourself estate planning. There could be issues overlooked. Just spend a little extra for the personalized guidance of an estate attorney.

Make gifts for young adults count

Cash and gift cards are the go-to gifts for young adults. They are helpful, but you can choose to impact their financial well-being through more meaningful gifts for you and the recipient.

I really hope you enjoyed this post. If you’d like to read more, you might like to consider subscribing to our regular posts. You can do so via the sign-up form below.