Updated January 2026 with current contribution limits and tax brackets.

When you’ve built substantial wealth, taxes become one of your biggest challenges. It’s a good problem to have, but you shouldn’t just accept it as inevitable. Tax laws are constantly evolving, making it a full-time job to keep up. Fortunately, many strategies can help preserve your wealth. Whether your goal is to minimize current taxes, prepare for retirement, manage estate transfers, or foster generational wealth, the following summary highlights your potential options.

Understanding the High Net Worth Tax Landscape

The most recent tax law change, The One Big Beautiful Bill Act, significantly impacted tax planning over the next several years.

Key OBBB Changes:

- Estate tax exemption permanently increased to $15 million per individual ($30 million for married couples) starting in 2026

- State and Local Tax (SALT) deduction cap temporarily raised, until 2029, to $40,000 for those with adjusted gross income under $500,000

- Pass-through business deduction made permanent at 20%

- Qualified Small Business Stock (QSBS) benefits expanded

Keep in mind that OBBB is just the latest tax law and that it is always subject to change. To build a tax-efficient plan, be prepared to adjust strategies as new provisions arise.

The High Net Worth Tax Challenge

Wealthy individuals face unique tax challenges:

High earners face multiple tax layers, including federal income tax (up to 37%), state and local income taxes (up to 13.3% in California), the Net Investment Income Tax (NIIT, a 3.8% federal tax on certain investment income), Additional Medicare Tax (a 0.9% extra tax applied to wages and self-employment income above a threshold), and potential estate taxes (a 40% federal rate on inheritance above the exemption).

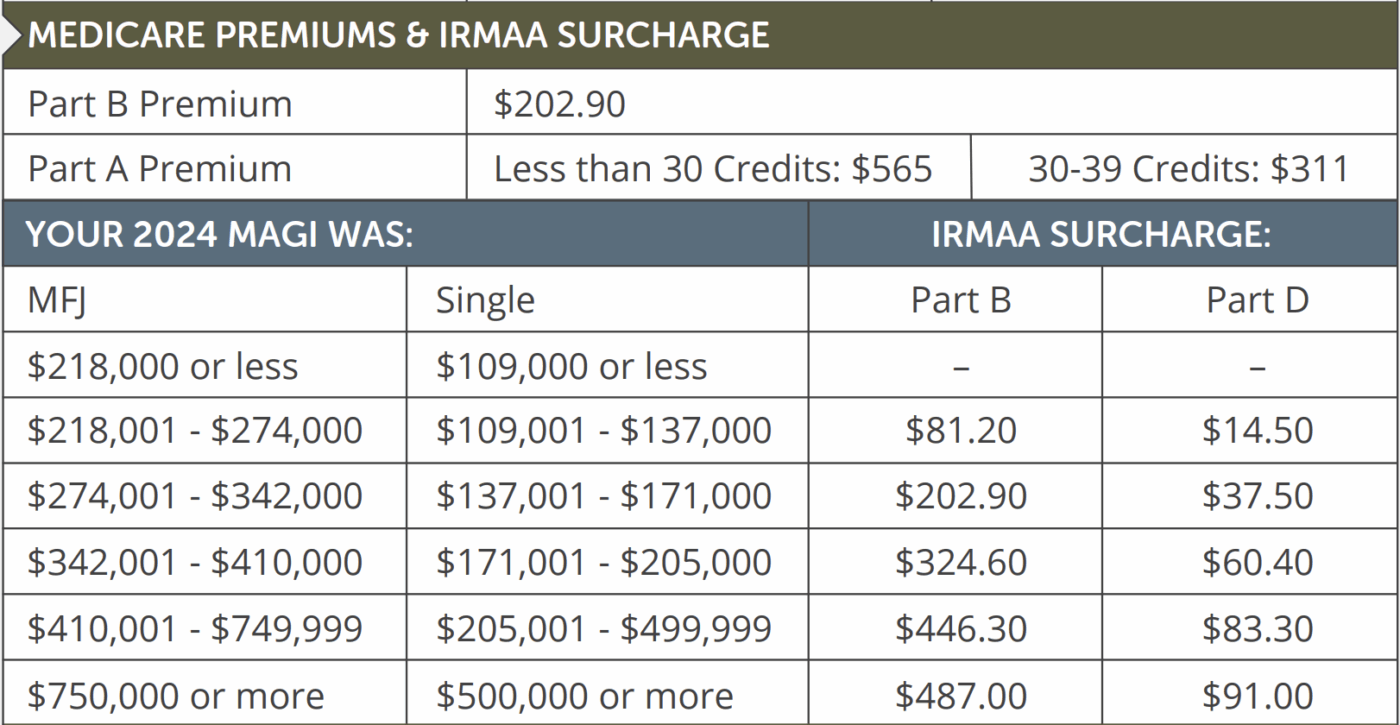

The Additional Retirement Tax Layer: At age 63, if your income exceeds certain thresholds, you may be required to pay higher Medicare premiums through the Income-Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your Medicare Part B (medical insurance) and Part D (prescription drug coverage) premiums based on your income. Medicare uses your tax return from two years prior to set this amount. That’s why you need to think ahead at 63, even though you don’t qualify for Medicare until 65. See the thresholds below.

Watch Out For The Tax Cliffs: The “tax cliff” occurs when earning slightly more income pushes you into a phase-out range where you lose valuable deductions or credits, creating effective tax rates that can exceed 50%.

For example, a single parent earning $199,000 keeps their full $2,000 Child Tax Credit, but earning $201,000 costs them $100 in credits plus regular taxes on that extra $2,000, making their effective rate on those dollars around 55%. Similarly, high earners in states like California or New York can face combined federal and state rates exceeding 50% when multiple phase-outs stack together.

Greater wealth introduces additional financial complexities, each of which requires specialized tax solutions that must be integrated into a comprehensive strategy.

Core High Net Worth Tax Planning Optimization Strategies

Income Management and Deferral Techniques

Managing taxable income is about reducing peaks to avoid higher tax brackets, much like smoothing traffic at a busy intersection.

Retirement Account Maximization & Optimization:

- Maximize 401(k) contributions: $24,500 annually (plus $8,000 catch-up if 50 to 59 and over 63) or $11,250 if (60 to 63)

- Pre-tax versus Roth: Your decisions depend on analyzing current and future tax liabilities when deciding how much to save in each type of account.

- After-tax Mega: If you can save a significant amount and your employer allows after-tax 401k contributions, you can supercharge your retirement savings with thousands of dollars in After-tax mega 401k contributions, along with the ability to convert it tax-free to a Roth. Visit our blog post After-tax 401(k) Contributions: Unlock the Powerful Savings to learn more.

- Consider Backdoor Roth Conversions: Taking advantage of this nice loophole that allows individuals who would otherwise be disqualified from contributing to a Roth IRA to do so, adding up significant tax-free retirement dollars over the years.

Roth Conversions: Implementing Roth conversions may be a wise move to save on retirement income taxes and reduce or eliminate IRMAA.

Health Savings Account (HSA): An HSA is a special account for qualified medical expenses open only to those enrolled in a high-deductible health plan (HDHP), which is a plan with higher annual deductibles than typical health insurance. It is the only triple-tax-advantaged savings tool, offering tax-deductible contributions, tax-free investment growth, and tax-free withdrawals when used for qualified medical costs. Check out our post 7 Ways an HSA Can Help You Know and In Retirement.

Deferred Compensation Plans: With a deferred compensation plan, you can defer part of your salary and income taxes until sometime in the future. Most plans are used as an additional executive retirement benefit. Higher earners can save more, obviously, and a deferred compensation plan allows them to do just that.

Investment Tax Efficiency Strategies

Asset Tax Allocation: This strategy is like organizing your garage. You want to put each item in the right spot for maximum efficiency. It means placing specific investments in the most tax-advantageous accounts, whether that’s your regular taxable investment account, pre-tax retirement accounts (like IRAs and 401(k)s), or tax-free Roth accounts, so that each investment can work hardest for you.

Tax-Loss Harvesting: This means selling investments that have lost value to offset the taxes due on other investment gains in non-retirement accounts. By the end of the year (often December), you can use these losses to offset gains, help rebalance your portfolio, and potentially save on taxes.

Opportunity Zones: These special investment areas serve as tax shelters with a social mission, encouraging investment in struggling neighborhoods. These offer some of the most attractive tax benefits available, potentially eliminating capital gains taxes on new investments held for ten years or more. However, there are investment risks and liquidity issues since your funds are locked up for ten years.

Advanced Estate Planning Strategies

We collaborate with estate planning attorneys who specialize in structuring advanced estate planning strategies and are well-versed in how changes to tax laws may impact them.

Multi-Generational Wealth Transfer

Dynasty Trusts: Utilize your generation-skipping transfer (GST) exemption, which is $15 million. This exemption provides a tax benefit for transfers to grandchildren or more distant descendants, allowing you to create trusts that benefit multiple generations and avoid estate taxes at each level.

The Power of Leverage: This exemption can protect millions in wealth through proper structuring and growth.

Grantor Trust Strategies

Intentionally Defective Grantor Trusts (IDGTs): Despite the name, these trusts are specifically designed for tax purposes. In an IDGT, you (the grantor) create a trust and transfer assets to it, but you deliberately retain certain rights that allow the IRS to treat you as the owner for income tax purposes. However, for estate tax purposes, the assets are considered out of your estate. This dual treatment is beneficial for tax planning.

The “Tax Payment Gift”: Every dollar you pay in income taxes on behalf of the trust is like making an additional gift that doesn’t count against your exemptions.

Sales to IDGTs: This common strategy enables you to sell assets to an Intentionally Defective Grantor Trust in exchange for a promissory note, a legally binding agreement by the trust to repay you over time. You continue to pay income taxes on the trust’s earnings. This can result in tax advantages similar to lending money to your family at favorable terms, while the IRS indirectly subsidizes the transaction.

Valuation Discount Techniques

Family Limited Partnerships (FLPs): These structures allow you to gift assets at discounted values, enabling the same economic value to transfer at a reduced gift tax cost.

Grantor Retained Annuity Trusts (GRATs): GRATs are perfect for appreciating assets. You retain an annuity payment while transferring appreciation to beneficiaries. Think of it as keeping the dividends while donating the stock.

Valuation Discount Techniques

Family Limited Partnerships (FLPs): These structures allow you to gift assets at discounted values, enabling the same economic value to transfer at a reduced gift tax cost.

Grantor Retained Annuity Trusts (GRATs): GRATs are perfect for appreciating assets. You retain an annuity payment while transferring appreciation to beneficiaries. Think of it as keeping the dividends while donating the stock.

Sophisticated Wealth Transfer Techniques

Qualified Personal Residence Trusts (QPRTs): QPRTs enable you to transfer your residence to heirs at a discounted value while continuing to live there, with the implied “rent” being considered rather than paid.

Grantor Retained Income Trusts (GRITs): Similar to QPRTs but for other assets like artwork or collectibles. These strategies are most effective when applied to assets that are expected to appreciate significantly.

Split-Interest Purchases: Purchase appreciating assets jointly with heirs, with you taking the income interest and heirs taking the remainder interest. The purchase price is split based on actuarial values, creating transfer tax savings.

Installment Sales and Self-Canceling Notes: These techniques enable you to spread the recognition of capital gains over multiple years, thereby transferring appreciation to your heirs. It’s like paying for a large purchase in installments rather than all at once.

Business-Focused Tax Strategies

Business Structure Optimization

Planning for business owners requires a different approach than traditional personal finance strategies. The tax rules and opportunities for business owners are complex and ever-changing, making it crucial to work closely with your professional team—your accountant, attorney, and CERTIFIED FINANCIAL PLANNER® professional to coordinate strategies that maximize both your business success and personal wealth. This collaborative approach ensures you’re taking advantage of every available opportunity while avoiding costly mistakes that could impact your financial future.

Pass-Through vs. C-Corporation Analysis: With the permanent 20% pass-through deduction under the OBBB Act, this decision is more important than ever. Both have advantages depending on your situation.

Key Considerations:

- Pass-through entities: Immediate 20% deduction, but income taxed at individual rates

- C-Corporations: 21% corporate rate, but potential double taxation on distributions

- State tax implications can significantly tip the scales.

Business Exit and Succession Strategies

Qualified Small Business Stock (QSBS): QSBS allows business owners to exclude up to $10 million in gains from the sale of qualifying small business stock. It’s like having an account where the first $10 million in profits are entirely tax-free.

Employee Stock Ownership Plans (ESOPs): ESOPs offer tax deferral on sale proceeds, motivate employees through ownership, and can provide estate liquidity. It’s like getting three different tax strategies rolled into one.

Recapitalization Strategies: Restructure your business into preferred shares (providing steady income) and common shares (capturing growth). Gift the common shares to heirs while retaining preferred shares for income.

Management Buy-Outs with Estate Planning Benefits: Structure management buyouts to provide partial liquidity while transferring remaining ownership to family members at attractive valuations.

Charitable Planning Strategies

Advanced Charitable Techniques

Charitable Lead Trusts (CLTs): While CRTs pay you first and charity later, CLTs pay charity first and beneficiaries later. They’re particularly powerful in low-interest-rate environments and for assets expected to appreciate significantly.

Private Foundations Private foundations give you complete control over your charitable giving and can operate forever, passing from generation to generation like a family business. However, they require significant administrative work, including annual tax filings, board meetings, and compliance with strict IRS rules. Think of it as owning your own charitable company rather than renting space in someone else’s building.

Donor-Advised Funds: Donor-advised funds work like having a charitable savings account custodied by a larger organization – you contribute money or investments with large gains. They’re much simpler to set up and maintain, with minimal paperwork and no ongoing administrative burden. While you give up some control, you gain convenience and can start giving meaningfully with much smaller initial contributions.

Charitable Remainder Trusts (CRTs): A CRT is like having your cake and eating it, too. You donate an asset to charity but receive income payments from it for life or a set period, plus get an immediate tax deduction. When the trust ends, the charity keeps what’s left, but you’ve enjoyed years of income while reducing your current tax bill and supporting a cause you care about.

Charitable Remainder Annuity Trusts (CRATs): CRATs function similarly to a pension. They pay you the same fixed dollar amount every year, regardless of how the investments perform. This provides a predictable income you can count on, such as receiving $50,000 annually, regardless of whether the market rises or falls. They’re ideal if you want steady, reliable payments and don’t mind missing out on potential growth when investments do well, which will benefit the charity after you pass away.

Charitable Remainder Unitrusts (CRUTs): The annual payment from a CRUT fluctuates based on the trust’s investment performance each year. If the trust grows to $1 million, you might receive $50,000 (5%), but if it shrinks to $800,000, you’d get $40,000 that year. Choose this option if you can handle variable income in exchange for the potential of higher payments when investments perform well. CRUTs are revalued every January 1st. Whatever the trust is worth on that date determines your payment for the entire upcoming year.

Geographic Tax Planning

State Tax Optimization

Domicile and Residency Planning: With state income tax rates ranging from 0% to over 13%, strategic changes in residency can result in significant savings of millions.

Key Considerations:

- Establish a clear domicile in tax-favorable states.

- Understand the “183-day rule” and maintain detailed records.

- Plan for state estate tax differences.

Trust Situs Planning: States compete by offering favorable trust tax rules. Moving trusts can save taxes.

Insurance as a Tax Strategy

Life Insurance in Estate Planning: Beyond basic coverage, life insurance can provide estate liquidity, equalize inheritances among children, and create tax-free wealth transfers through proper structuring.

Private Placement Life Insurance (PPLI): PPLI enables sophisticated investors to access alternative investments within a life insurance framework, offering tax-deferred growth and tax-free distributions. Think of it as creating a private mutual fund with exceptional tax benefits.

High Net Worth Tax Planning Implementation Framework

Building Your Advisory Team

Your Advisory Dream Team: Effective high net worth tax planning requires coordination among multiple professionals:

- Tax attorneys for complex legal structures

- CPAs for compliance and ongoing planning

- CERTIFIED FINANCIAL PLANNER® professional

- Insurance professionals for risk management

- Estate planning attorneys for wealth transfer strategies

This collaborative approach ensures you’re taking advantage of every available opportunity while avoiding costly mistakes that could impact your financial future.

Common Pitfalls to Avoid

Strategic high Net worth tax planning Mistakes

To avoid taxes, advanced tax strategies should always support your overall objectives without overshadowing them. The strategy needs to save taxes and increase wealth. For example, getting a mortgage to receive an interest deduction is not a wise choice, as it does not increase your wealth.

The “Perfect Timing Myth”: Markets and tax laws are unpredictable. Consistent, disciplined strategies typically outperform attempts to time perfect moments.

The “DIY Disaster”: High-net-worth tax planning involves complex regulations and significant financial consequences. Professional guidance is essential. The cost of mistakes can far exceed the investment in proper advisory services.

The “One-Size-Fits-All Fallacy”: Strategies that work for one family may not be suitable for another. Customization is essential.

Looking Ahead: Future Planning Considerations

Adapting to Change

Political and Legislative Risk: Tax laws are subject to frequent changes. Build flexibility into your strategies and stay informed about potential changes. The OBBB demonstrates how quickly significant changes can occur. Comprehensive strategies should account for various political scenarios.

Election Cycle Planning: Tax policies often correlate with political cycles. Develop contingency plans for various electoral outcomes, including acceleration or deferral strategies that can be implemented promptly if changes to tax law appear imminent.

Family Governance: As wealth grows and families expand, governance becomes crucial. Establish clear communication channels and decision-making processes.

Multi-Generational Perspectives: Different generations often have varying risk tolerances, investment preferences, and philanthropic interests. Successful families create structures that honor these differences while maintaining overall strategic coherence.

Succession Planning Beyond Taxes: While tax efficiency is important, don’t overlook preparing the next generation to manage wealth responsibly.

Wealth Psychology and Family Dynamics: Technical tax strategies must consider human factors. Some of the most tax-efficient strategies fail because they don’t align with family values or create unintended interpersonal conflicts.

Stress Testing Your Plan

Scenario Analysis: Regularly test your tax strategies against various scenarios, including market downturns, changes in tax law, family emergencies, and shifting personal circumstances.

Liquidity Planning: Ensure sufficient liquidity to meet tax obligations, especially during estate tax events or business transitions. Many sophisticated strategies can create cash flow mismatches if not properly coordinated.

Exit Strategy Development: Every complex strategy should include clear exit provisions. Circumstances change, and strategies that made sense initially may need modification or termination.

The high net worth tax planning Path Forward

High-net-worth tax planning is not a destination, but a journey.

Your Next Steps:

Assessment: Review your current tax situation and identify optimization opportunities

Planning: Develop a comprehensive strategy that coordinates all aspects of your financial life

Implementation: Execute strategies with proper professional guidance

Monitoring: Regularly review and adjust as laws and circumstances change

The Ultimate Goal: Remember that tax planning is a means to an end, preserving and growing wealth to achieve your family’s long-term objectives.

Advanced planning techniques create opportunities for high-net-worth families. By understanding these strategies and working with qualified professionals, you can potentially save millions in taxes while building a lasting legacy for future generations.

You need to plan ahead. Time is often the most valuable component of any tax strategy, and the earlier you get a plan in place, the easier it is to implement at the appropriate time. It’s essential to work with someone who understands these sometimes complex provisions and how they apply to your situation.

This article provides general information for educational purposes and should not be considered specific tax or legal advice. High-net-worth tax planning involves complex strategies that should only be implemented with the guidance of a qualified professional tailored to your specific situation.