If you’re between 60 and 63, you can sock away an extra $3,250 in your 401(k) compared to other catch-up savers. That’s real money, and it’s one of several changes you need to know about.

Contribution limits shown are for 2026. We update this article annually when the IRS releases new figures.

Thanks to SECURE 2.0, the retirement savings rulebook got a major update. The changes vary depending on your age, your income, and what type of retirement plan you have. Let’s break it down.

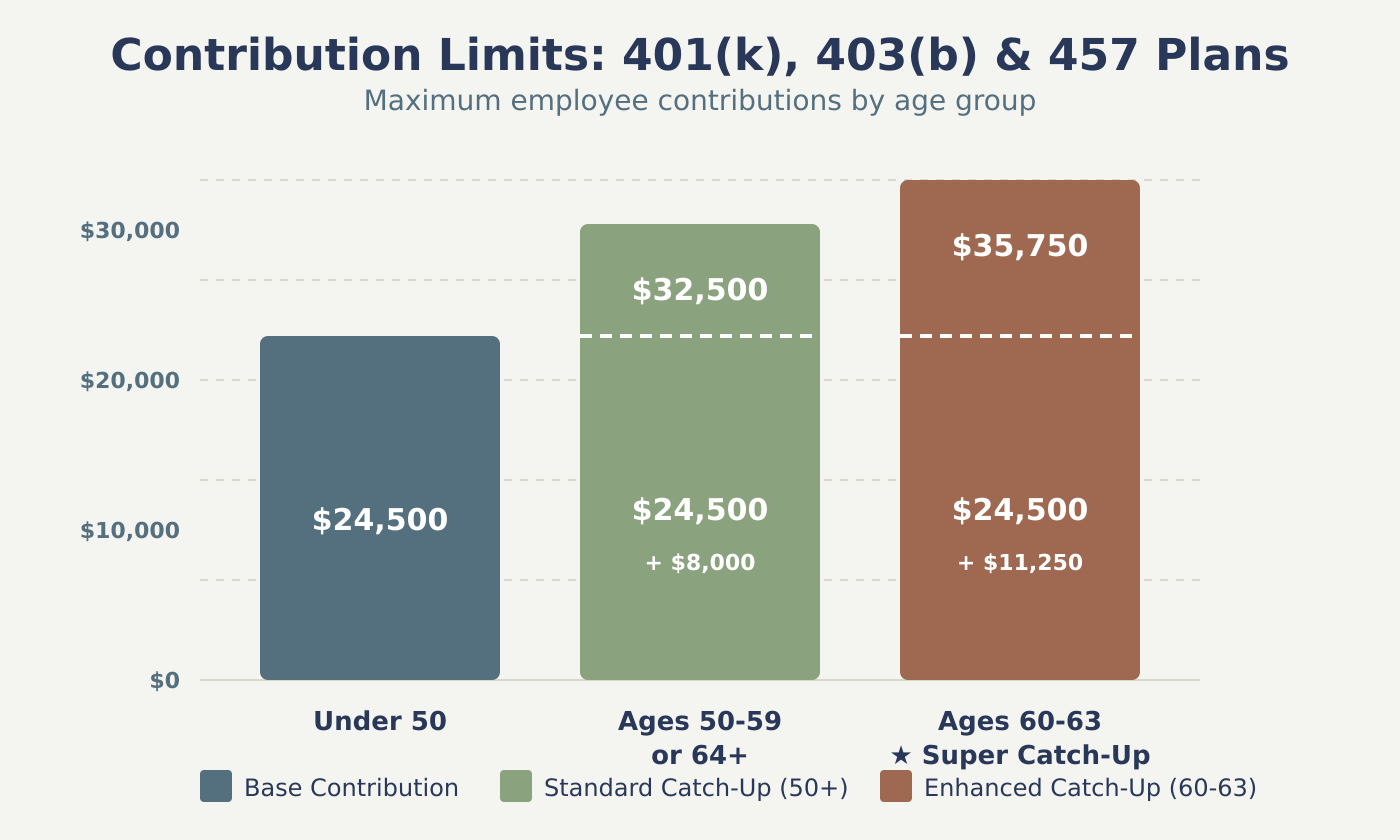

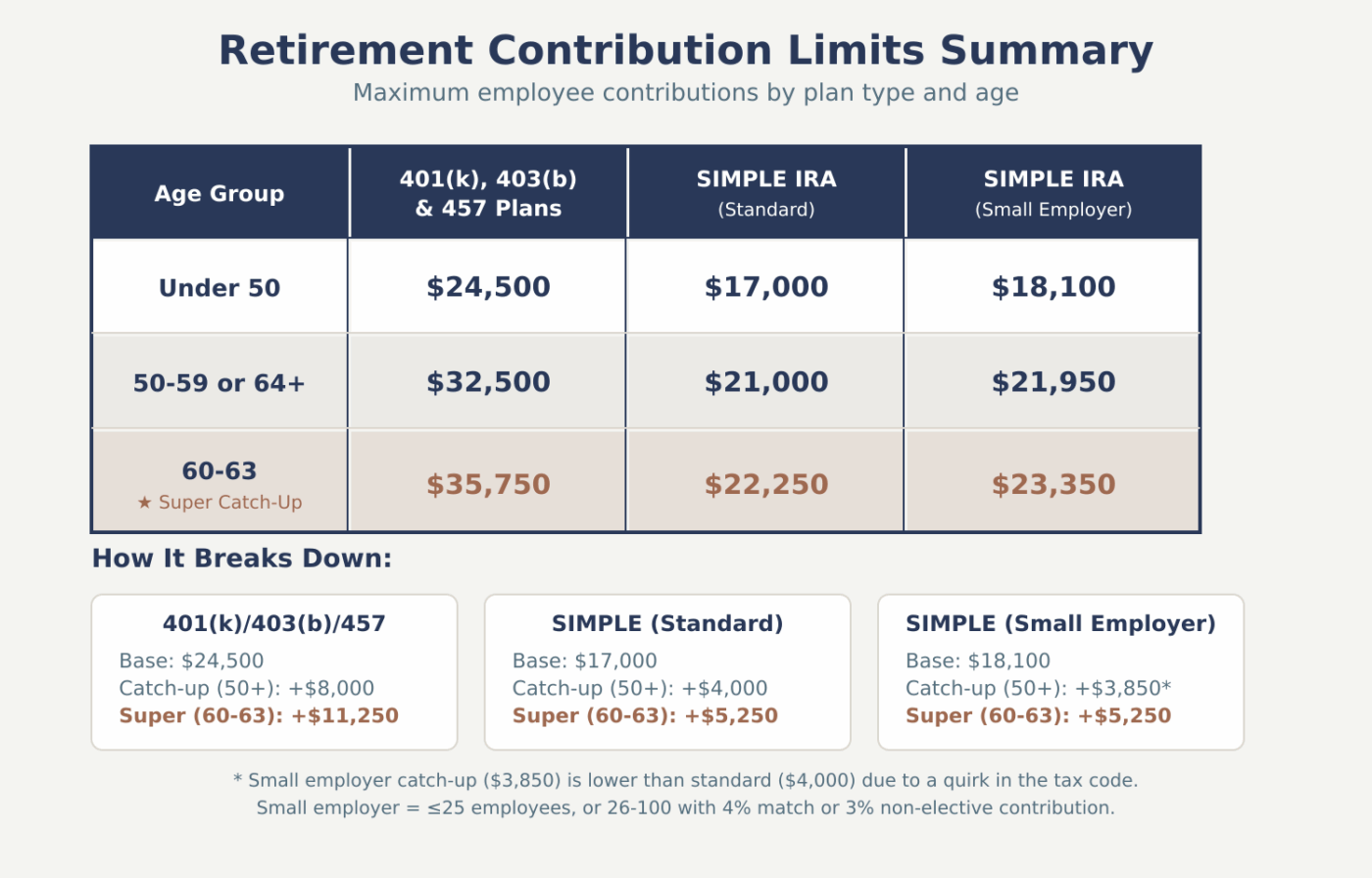

If You Have a 401(k), 403(b), or 457 Plan

These are the most common workplace retirement plans, so let’s start here.

The Basics (Everyone)

You can contribute up to $24,500 to your plan. That’s the baseline for everyone under 50.

The Standard Catch-Up (Ages 50+)

Once you hit 50, you get access to catch-up contributions, an extra $8,000 on top of the $24,500 base. Think of it as the government acknowledging that your 20s and 30s might not have been your peak saving years.

Total if you’re 50-59 or 64+: $32,500

The “Super Catch-Up” (Ages 60-63 Only)

Here’s the big opportunity. If you’re 60, 61, 62, or 63, you qualify for an enhanced catch-up of $11,250, which is $3,250 more than the standard catch-up.

It’s like a limited-time turbo boost for your retirement savings, available only during this four-year window.

Total if you’re 60-63: $35,750

Important details:

- Your age is determined as of December 31. Turn 60 in December? You qualify for the whole year.

- Turn 64 anytime during the year, even December 30? You’re back to the standard catch-up for the year.

- This is optional for both employees and employers. Your plan sponsor has to offer it.

Bonus for Long-Tenured 403(b) Participants

If you’ve worked for the same school, hospital, church, or nonprofit for at least 15 years, you may qualify for an additional catch-up—regardless of your age.

This 15-year service catch-up lets you contribute an extra $3,000 per year, up to a lifetime maximum of $15,000. The catch? You can only use it if you haven’t been maxing out your contributions in prior years.

This stacks with the age-based catch-ups. So a 62-year-old teacher with 15+ years of service could potentially contribute up to $38,750:

- $24,500 base + $3,000 (15-year) + $11,250 (super catch-up) = $38,750

Not all 403(b) plans offer this, so check with your plan administrator.

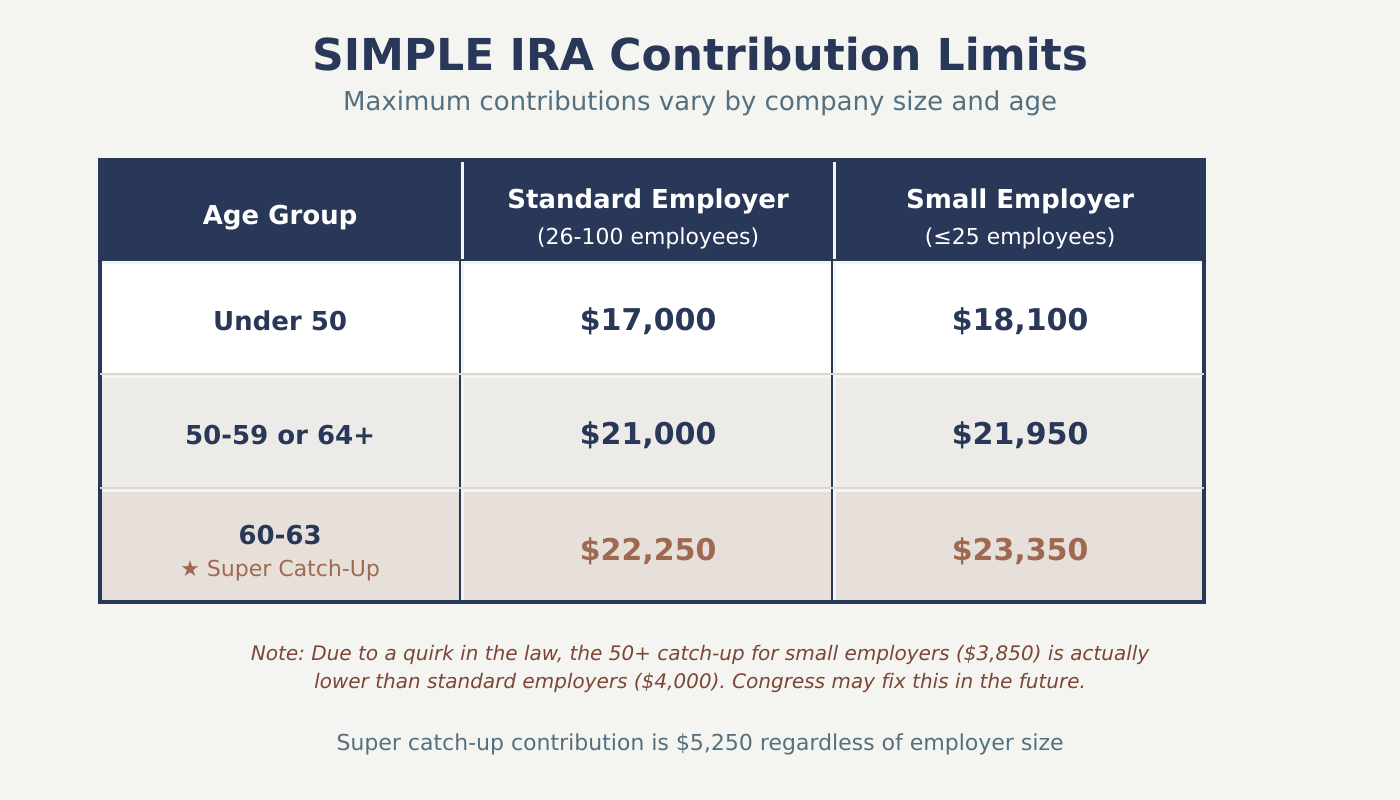

If You Have a SIMPLE IRA

SIMPLE IRAs used to live up to their name. Not anymore.

What Changed

The SECURE Act 2.0 introduced a 10% bump in contribution limits—but whether you get it depends on how many people work at your company. It’s like ordering a “simple” coffee and being asked about the size, roast, milk type, and temperature.

Leave it to the government to take an easy-to-understand SIMPLE IRA contribution limit and make it confusing. It’s not simple anymore.

The Rules by Company Size

25 or fewer employees: You automatically get the 10% increase.

- Base contribution: $18,100

- Catch-up contribution (50+): $3,850 (yes, this is actually lower than the standard catch-up due to a quirk in the law)

26-100 employees: Your employer can opt in to the higher limits, but only if they sweeten the deal with either a 4% match or a 3% contribution to everyone.

Larger employers without the increased contribution:

- Base contribution: $17,000

- Catch-up contribution (50+): $4,000

The SIMPLE IRA “Super Catch-Up” (Ages 60-63)

Just like with 401(k)s, SIMPLE IRAs now have an enhanced catch-up for the 60-63 crowd. The limit is $5,250 regardless of company size.

Maximum contributions:

| Age Group | Standard Employer | Small Employer (10% increase) |

|---|---|---|

| Under 50 | $17,000 | $18,100 |

| 50-59 or 64+ | $21,000 | $21,950 |

| 60-63 | $22,250 | $23,350 |

If You’re a High Earner: The Roth Catch-Up Rule

Here’s a significant change that affects high earners.

If you earned more than $150,000 in FICA wages from your employer in the prior year, your catch-up contributions must go into a Roth account—no exceptions. This applies to both the standard catch-up and the enhanced 60-63 catch-up.

What does this mean practically? You’ll pay taxes on that money now instead of later.

Think of it as the government saying, “If you’re earning this much, you can afford to pay taxes now and let your money grow tax-free in retirement.”

Whether this helps or hurts you depends on one question: Will your tax rate be higher now or in retirement? For most high earners, paying taxes now and getting tax-free growth could actually be a win, but it’s worth running the numbers for your situation.

Important: If your employer’s plan doesn’t offer a Roth option, you may not be able to make catch-up contributions at all. Check with your HR department to avoid surprises.

The Bottom Line

These rules give people aged 60-63 a unique window to supercharge their retirement savings. It won’t last forever—once you hit 64, you’re back to the regular catch-up limits.

If you’re in that sweet spot, talk to your HR department or plan administrator to make sure your employer has enabled the enhanced catch-up option. Then consider whether maxing it out fits your overall financial picture.

And if you’re a high earner, make sure your plan offers Roth contributions—the mandatory Roth catch-up rule is now in effect.

The most critical step? Actually taking advantage of it. The rules only help if you use them.

Have questions about how these changes affect your retirement strategy?