You’ve spent decades saving for retirement. Now comes the part nobody prepared you for: learning exactly how to spend money in retirement.

For most of your working life, the message was simple. Save more, spend less, watch your accounts grow. You trained your brain to see a rising balance as success and a falling one as trouble. But the day you retire, the rules of the game change completely.

This shift is a different skill set entirely. It requires moving from accumulation to “decumulation”—the strategic process of withdrawing your savings to fund your life.

Think of it like learning to drive in a country where they drive on the opposite side of the road. The skills you developed aren’t wrong. They just need to be applied differently. This guide will help you navigate that transition and create a spending strategy that lets you enjoy retirement without constantly worrying about running out of money.

If you are starting your retirement planning journey, check out our Ultimate Guide to Retirement Planning

The Mindset Shift: Permitting Yourself to Spend

The biggest hurdle for most new retirees isn’t the math. It’s the mindset. Researchers call it “saver’s guilt.” After 30 or 40 years of building good saving habits, many retirees find themselves unable to enjoy the money they’ve accumulated.

Here’s the uncomfortable truth: money is a tool, not a high score.

You don’t get an award for dying with the most. It often means you may have worked longer than you needed to, worried or scrimped more than you had to, or missed experiences that would have enriched your life. A successful retirement plan isn’t just about not running out of money; it’s about not running out of life before you have a chance to enjoy the savings you worked your entire life for.

The goal is to find the right pace, like a marathon runner who finishes strong rather than either burning out early or crossing the finish line with too much left in the tank.

Understanding Where Your Retirement Income Comes From

Before you can spend confidently, you need to understand your income sources. Think of your retirement income like a house:

- Social Security: These are your foundation and load-bearing walls. It acts like a pension—a steady monthly check that adjusts for inflation and lasts your entire life. For many retirees, this covers basic living expenses.

- Pensions: If you are fortunate enough to have one, these also form the structure of your house, a predictable income you can count on.

- Your Investment Portfolio: This is the flexible piece, like the rooms you can renovate. This is money in 401(k)s, IRAs, and brokerage accounts that you will draw from over time.

Think of your retirement income like a house. Social Security is the foundation. Solid and reliable, but typically only covering about 40% of your needs. But the roof and walls? That comes from you. With traditional pensions or other income sources making up just 15% of the average pie, your investment portfolio must do the heavy lifting, providing roughly 45% of your monthly cash flow. This is why your withdrawal strategy isn’t just a math formula; it’s the engine that keeps retirement running.

How to Spend Money in Retirement: 3 Proven Withdrawal Strategies

When figuring out how to spend money in retirement, you need a system. A structured withdrawal strategy removes the guesswork and fear. Here are three of the most effective methods:

1. The 4% Rule (The Classic Approach)

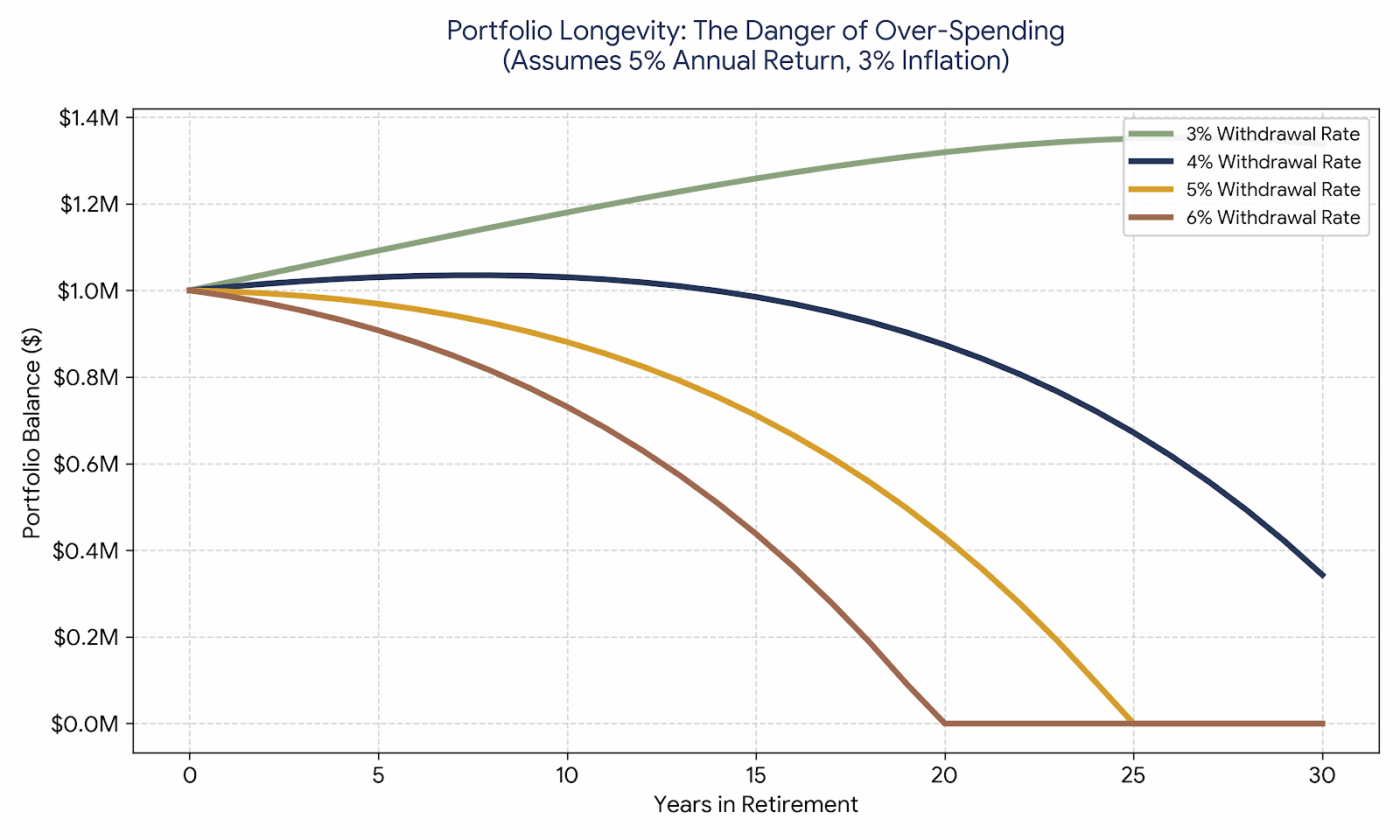

This approach suggests withdrawing 4% of your portfolio in the first year of retirement, then adjusting that amount for inflation each year after.

- Example: A $1 million portfolio would provide $40,000 in year one. If inflation is 3%, you’d withdraw $41,200 in year two.

- Pros: Provides steady, predictable income. Easy to understand.

- Cons: Can be too rigid. If the market crashes early in retirement, withdrawing the same inflation-adjusted amount can hurt your portfolio’s longevity.

2. The Bucket Strategy (The Psychological Favorite)

This method segments your money into three “buckets” based on when you need to spend it:

- Bucket 1 (Now): 1–3 years of living expenses in cash or high-yield savings.

- Bucket 2 (Soon): 3–10 years of expenses in conservative bonds.

- Bucket 3 (Later): 10+ years of expenses in growth investments.

- Why it works: You always know your immediate spending money is safe, regardless of what the stock market does today. When markets drop, you spend from Bucket 1 while Buckets 2 and 3 have time to recover.

3. The Dynamic Spending Rule (The Flexible Approach)

This is an adaptive version of the 4% rule. If the market performs well, you give yourself a modest raise. If the market drops, you tighten spending to essentials. Think of withdrawal rates like a thermostat, not a light switch. You can adjust them based on conditions rather than locking in one number forever.

This doesn’t mean you spend everything you withdraw, but while performance is good, you take a little more and sock it away in a money market account.

- Why it works: This flexibility is often the safest way to ensure your money lasts while still allowing you to enjoy good years.

As the graph illustrates, the difference between a secure retirement and a depleted portfolio is often just one or two percentage points. This is why we recommend remaining flexible. You don’t need to pick one withdrawal rate and stick to it blindly for 30 years. You need a plan that allows you to adjust when life (or the market) changes.

Still have concerns about whether your plan can handle market volatility? Read our guide: 25 Questions to Ask a Financial Advisor About Retirement

The Spending Smile: A New Way to Spend Money in Retirement

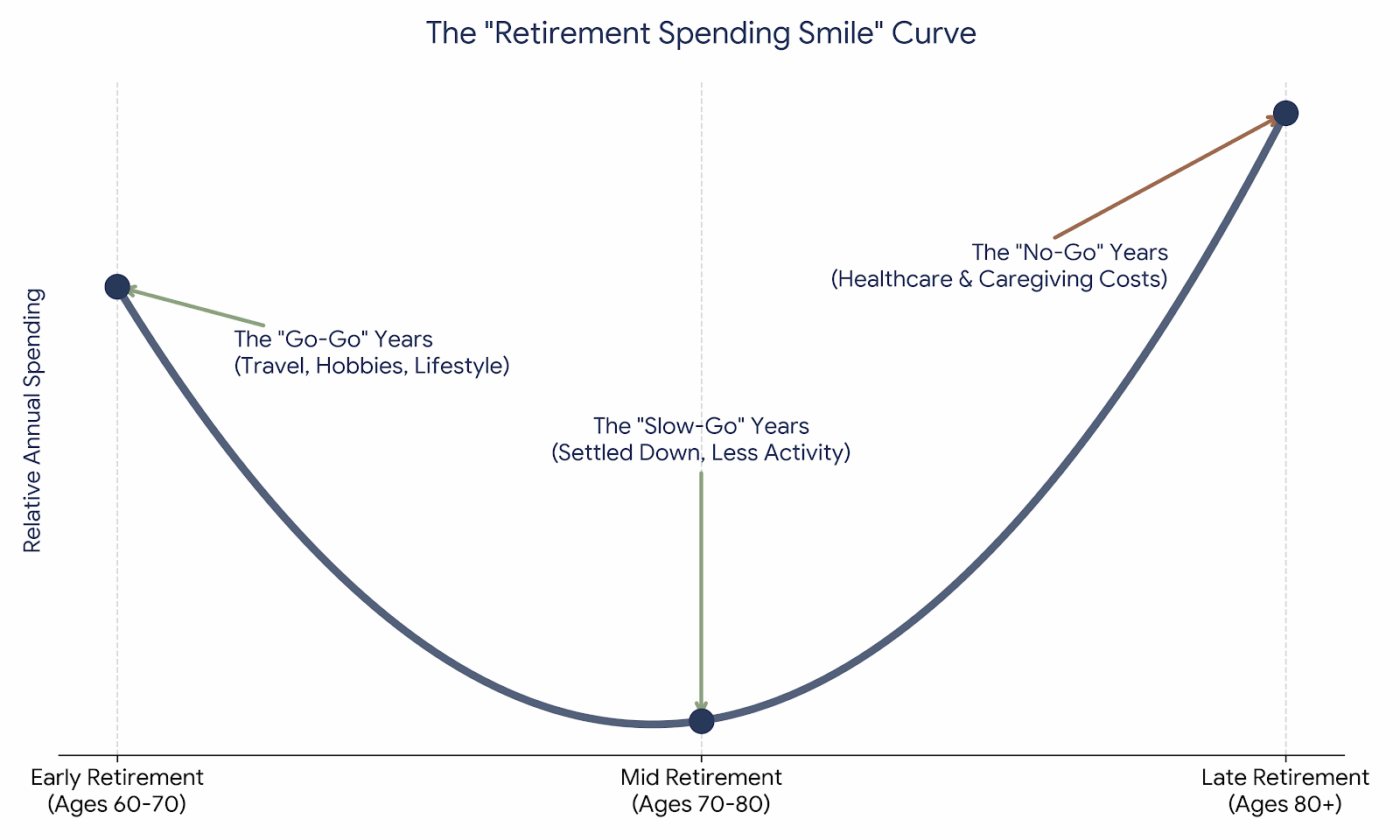

Here’s something that surprises many new retirees: you probably won’t spend the same amount every year. Research shows that retirement spending typically follows a “smile” pattern:

- The Go-Go Years (Early Retirement): Spending is highest. You’re traveling, dining out, pursuing hobbies you never had time for, and checking items off your bucket list.

- The Slow-Go Years (Mid-Retirement): Spending naturally decreases. You travel less, prefer simpler routines, and settle into a comfortable rhythm.

- The No-Go Years (Late Retirement): Spending rises again, driven mainly by healthcare and potential long-term care costs.

What this means for you: Don’t budget for a flat line. Front-load your spending plan for the Go-Go years so you can maximize experiences while you have the health and energy to enjoy them. You don’t need to save for expensive international travel at age 85, but you might regret not taking that trip at 67.

Seeing this curve often brings a sense of relief. It means you don’t need to hoard every penny for age 85; you have permission to spend more now while you have the health and energy to enjoy it.

However, funding this variable spending requires a strategy. If you pull from the wrong accounts during those high-spending ‘Go-Go’ years, you could accidentally trigger a massive tax bill that hurts your portfolio later. Let’s look at exactly which accounts you should tap first.

Tax-Smart Spending: Which Accounts to Tap First

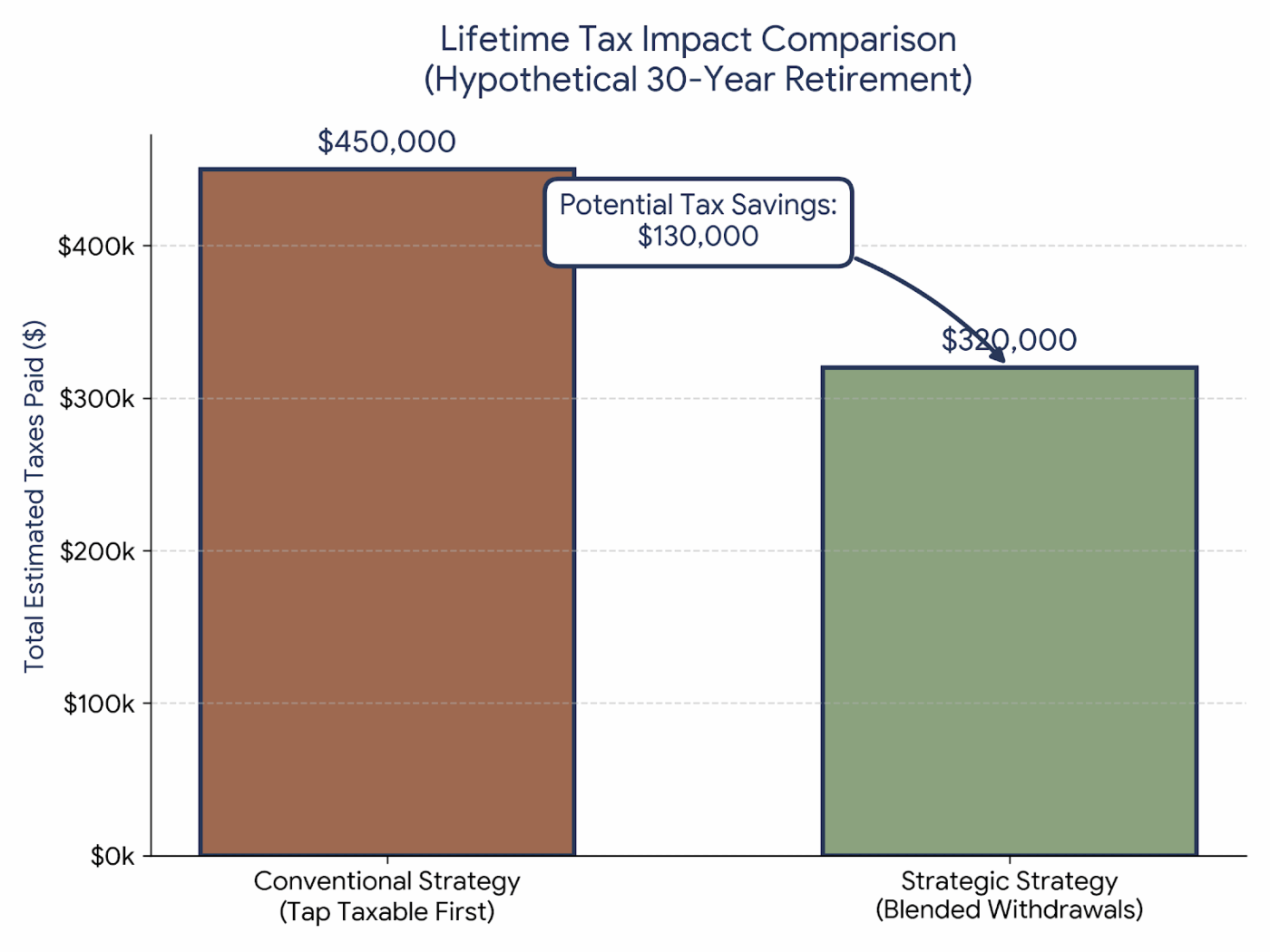

The order you tap your accounts matters more than most people realize. Done well, strategic withdrawal sequencing can save tens of thousands of dollars in taxes over your retirement.

Conventional wisdom says to spend in this order:

- Taxable accounts (brokerage accounts)

- Tax-deferred accounts (Traditional IRAs/401ks)

- Tax-free accounts (Roth IRAs)

However, the smarter approach often involves a mix. In lower-income years, especially before Social Security kicks in or Required Minimum Distributions start, you might deliberately withdraw from tax-deferred accounts or do Roth conversions to “fill up” lower tax brackets. This prevents a larger tax bill later.

Think of your different accounts like fuel tanks on a hybrid vehicle. The goal isn’t to empty one tank completely before refueling with another; it’s to use each type of fuel when it’s most efficient.

Saving $130,000 just by changing which account you pull money from? That’s real money that could fund years of extra travel or be left as a legacy for your family. Of course, executing a strategy like this requires careful planning and annual adjustments. This is where working with a professional pays off. Let’s look at how to put all these pieces together.

Creating Your Retirement Spending Plan

A good spending plan divides your expenses into categories based on their importance. This framework lets you enjoy your money while automatically building guardrails.

- Foundation Expenses: The non-negotiables (housing, food, healthcare, utilities). These need to be covered no matter what happens in the market. Ideally, your guaranteed income (Social Security, pension) covers most of these.

- Lifestyle Expenses: The things that make retirement enjoyable (travel, hobbies, dining out). These can flex up or down depending on how your portfolio performs.

- Legacy Goals: Money you want to leave to heirs or charity. These are the most flexible of all.

The Retirement Hierarchy of Needs

Think of your spending plan like a pyramid. You must secure the bottom layer before you worry about the top.

🔼 Level 3: Legacy (The Peak)

- Gifting, Charity, Inheritance.

- Funded only after you are secure.

🔶 Level 2: Lifestyle (The Middle)

- Travel, Hobbies, Dining Out.

- Discretionary spending that can be cut if the market drops.

🟦 Level 1: Essentials (The Foundation)

- Housing, Food, Healthcare, Utilities.

- This income must be guaranteed (Social Security, Pensions, Annuities).

Practical Tips for Spending With Confidence

- Set up a “paycheck” system: Have a set amount transferred to your checking account each month, as you did when you were working. This creates a familiar structure and prevents the anxiety of watching large withdrawals leave your portfolio.

- Build a cash buffer: Keep 1–2 years of expenses accessible in cash. When markets drop, you spend from the buffer instead of selling investments at a loss. This lets you sleep at night and gives your portfolio time to recover.

- Review and adjust annually: Your spending plan isn’t carved in stone. Each year, review your portfolio value, spending, and goals. Make small adjustments rather than dramatic changes.

Conclusion

Retirement spending decisions involve taxes, investments, Social Security timing, healthcare costs, and estate planning, all of which interact with one another. But the most critical part is permitting yourself to use the tool you built. You worked hard to build your nest egg—you deserve to enjoy the omelet.

Ready to Map Out Your Spending Plan?

Don’t guess at the numbers. Download our free Retirement Spending Worksheet to categorize your essential vs. discretionary expenses, calculate your sustainable withdrawal rate, and choose the strategy that fits your life.